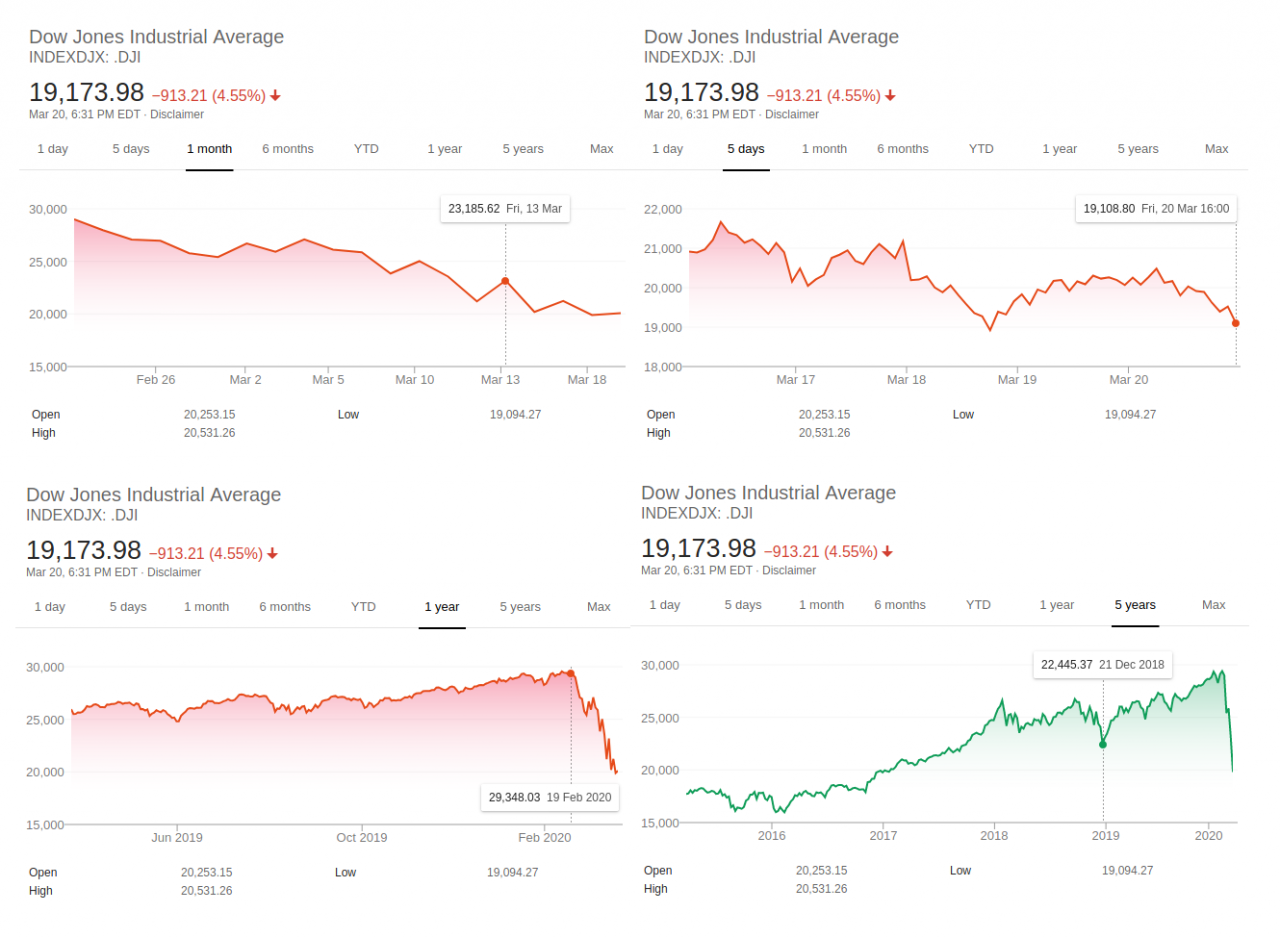

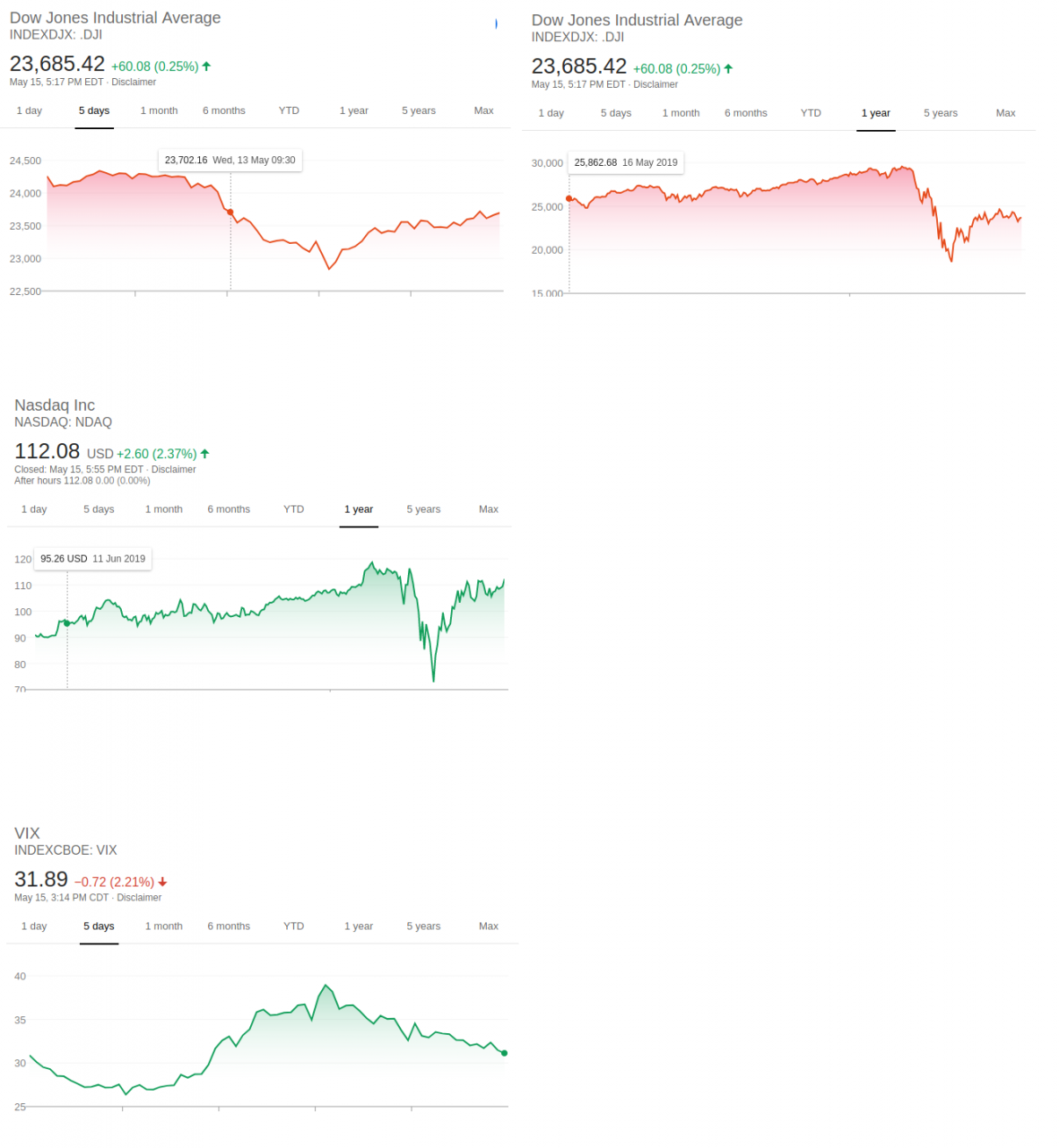

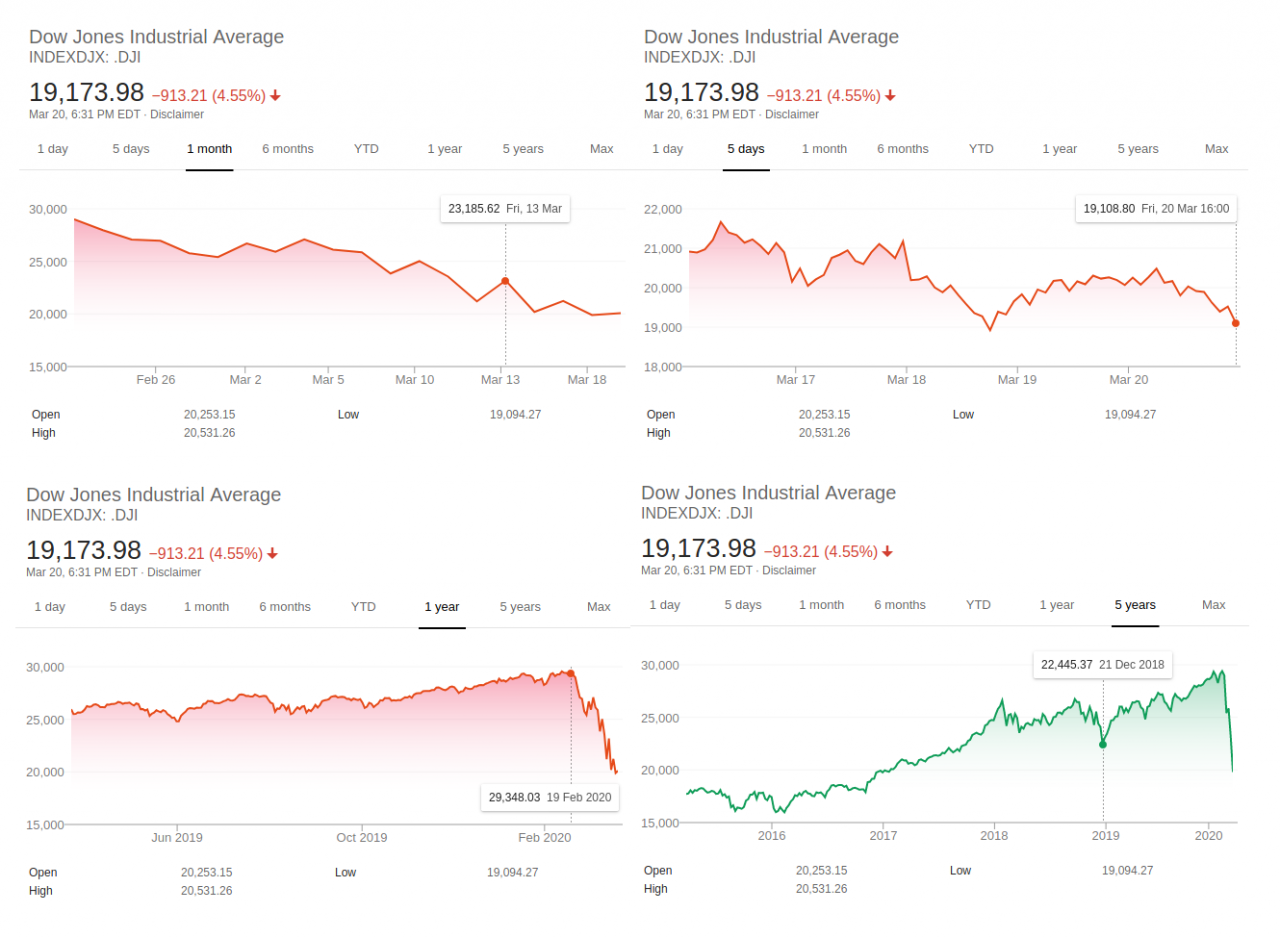

Monday, March 16 the markets went down about 10% in the morning, then they were up a couple hours later to only down 7 or 8% I think, but closed just under 13% down, the biggest drop since 1987. Gold went down less than a percent. Brent went 15% down under $30. Bitcoin down, I'm not sure how much. The VIX was up 43% at 83. Gold stocks a lot were up, some up a lot. Some stocks went up. It wasn't like most of the big down days in the stock market where all stocks were down except really only a few. Village Farmers Market and Sprouts Farmers Market, for example, were up 12 and 5%.

There seems to be a kind of competition for which country will develop the vaccine. There's news headlines the US government tried to buy a vaccine or something from Germany to have total control over it. I haven't really read it yet so can't comment except people are talking about it and Germany later issued a response it wasn't for sale in that way.

The FED cut rates to 0. Analysts thought he would not do that. Jay Powell has said he didn't want to do that but would instead go with quantitative easing, as I mentioned quite a bit above.

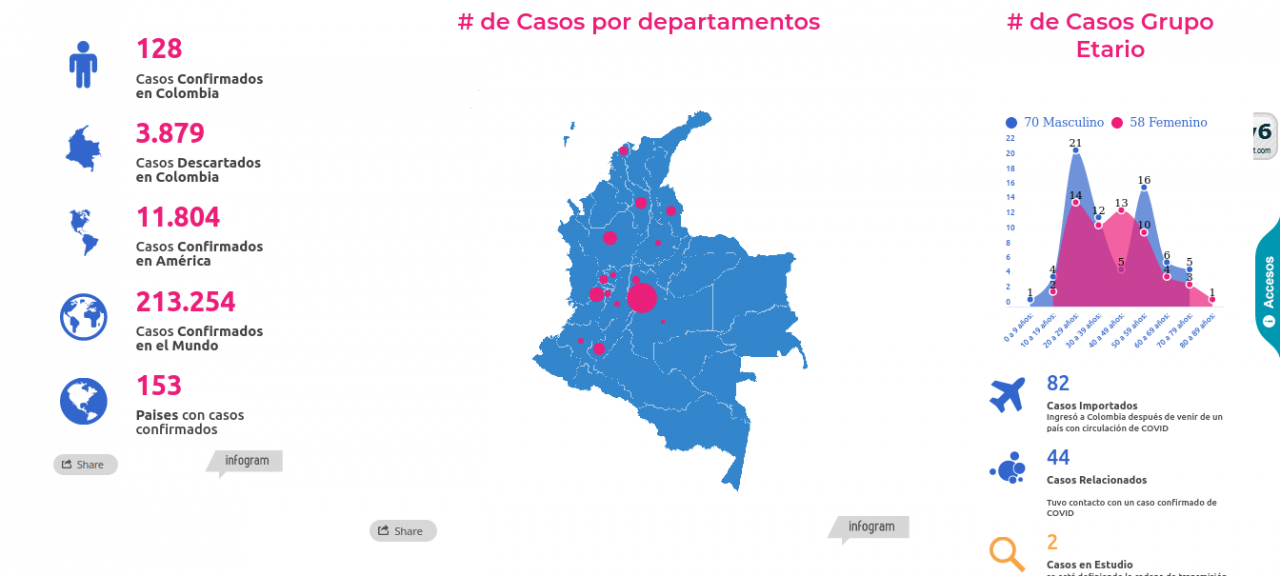

This city has I think 9 cases, the country about 50. That's confirmed so maybe 500 total, and 100 in this city. I've started to buy groceries and put them in my apartment. And cleaning products. I'm going to look into what antibiotics and anti-inflammatories to get, and keep getting stuff each day. I'm downtown, and don't know this city very well or have great connections or a vehicle. Most people downtown probably don't have a vehicle though. Stores are just now starting to sell out of a couple things. Maybe next week they will be in the sad state we see other countries stores in.

I'm just coming off a regular flu. My chest hurts a bit today, I think the last stage. I'm thinking a lot I'd like to pass this flu before getting exposed to Coronavirus. Although I understand your body is weak for a while after you recover from the flu. I'm not sure if your immune system is ready to go right after or it takes time as well.

I asked a few people about properties outside of town, but no one knows anyone, neither did they know about apartments when I was searching for one a couple months ago.

The borders are closed to incoming I think, and citizens etc who enter must self-quarantine. That's the same in my own country, where there are more confirmed cases, and where stores are already selling out of most stuff.

France and most EU nations closed their borders for 30 days. Around 100m people are locked down in Europe.

Airlines had negative bookings (more cancellations than new bookings).

The US now has some drive-through test centers, and is going to do more testing I heard.

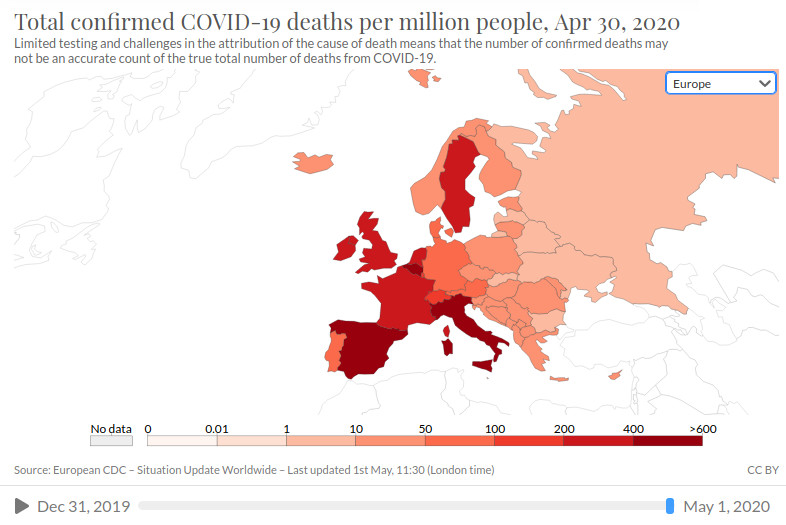

We still don't understand the fatality rate. France looks like 2%, Spain 3%, UK 2.5% (although that's only of detected tests), Italy over 6% (1400 deaths). In Europe, there are around 3 doctors per 1000. The UK has 5000 ventillators, and the government has called for more and said all will be bought, and things have gone into a wartime footing to switch production from whatever factories are making to ventillators.

Over 70s are to self-isolate (maybe for 4 months) in the UK and I think in Canada.

It looks like people hadn't been catching Coronavirus twice, which was something people were looking at, and people just hadn't cleared the virus the first time.

Countries (Austria, which has de facto quarantined the Tyrol region, and Romania) are enforcing non-movement with police and fines. Police will break up groups. They won't engage you if you're alone. Restaurants are closed. People who come from other countries and are under the 14-day quarantine will be checked in periodically by police and if they're not there they are fined and get a criminal file.

In times like this, opposite to regular times, I think there's a strong desire for a strong, forceful controlling presence and enforcement of quarantine, such as police to keep people from doing risky-to-public-health things. Also for the government to provide and increase health facilities and the necessary health equipment (manufacture). These police enforcement measures (police checking in on self-quarantine people) may even be referred to as 'draconian' but I write right now that it's welcome and bears a sense of relief to hear that type of action is taking place. It's not like regular times at all. However, the line must be drawn at crossing the line into human rights violations in terms of privacy, expression ie tracking, recording. Also, time like these when the people are concerned about health they couldn't care less about abusive laws that can be passed in the political halls of justice. So probably in a fair and just State these types of things (passing of non-essential laws and laws not related to the matter at hand (exclusively ie no mixed in laws) should be postponed to a more relaxed time. So what would meet my feelings ideally from a government would be to be quite totalitarian and draconian in preventive and protective measures, while assuring us no other things would go on which we wouldn't be able to properly monitor or participate in.

Governments SHOULD however pass laws against profiteering, such as buying up supplies and selling them for a profit.

China has passed laws against getting around regulations, like people who might take tylonol to reduce their symptoms before getting on a flight, has a 6 year jail term.

We're now 10 weeks into the virus.

Looking at the psychology of the virus, a few things. Africans because they hadn't had any cases thought they were immune to it, I've heard. Now there are cases in countries like Kenya, Ethiopia, Sudan (ones we get news from). What I wrote above about baby boomers not changing their behavior. People everywhere putting the whole thing off until there's a panic. I notice I myself prefer to think about and even write the lowest number possible for the cases in my country.

There seems to be evidence building that anti-inflammatory drugs (NSAIDs like Aspirin, ibuprofen, naproxen, advil, motrin, diclofenac) could aggravate the infection when there is a fever or infection. There are other drugs that reduce fever but are not anti-inflammatory like tylenol, acetominophen, but whether they should be used is debated. This is being shared around social media and news.

I haven't seen anyone talking yet about what is going to happen when in 4 months China and Korea have removed Coronavirus, and the US and Europe have largely gone through it. Who can travel?

Boeing had its credit rating changed by S&P to one grade above junk status (BBB). They were it by Fitch last week. They had lots of cash a year ago. Now they're probably around 3x leveraged.

HAIN (healthy food conglomerate group) stock.

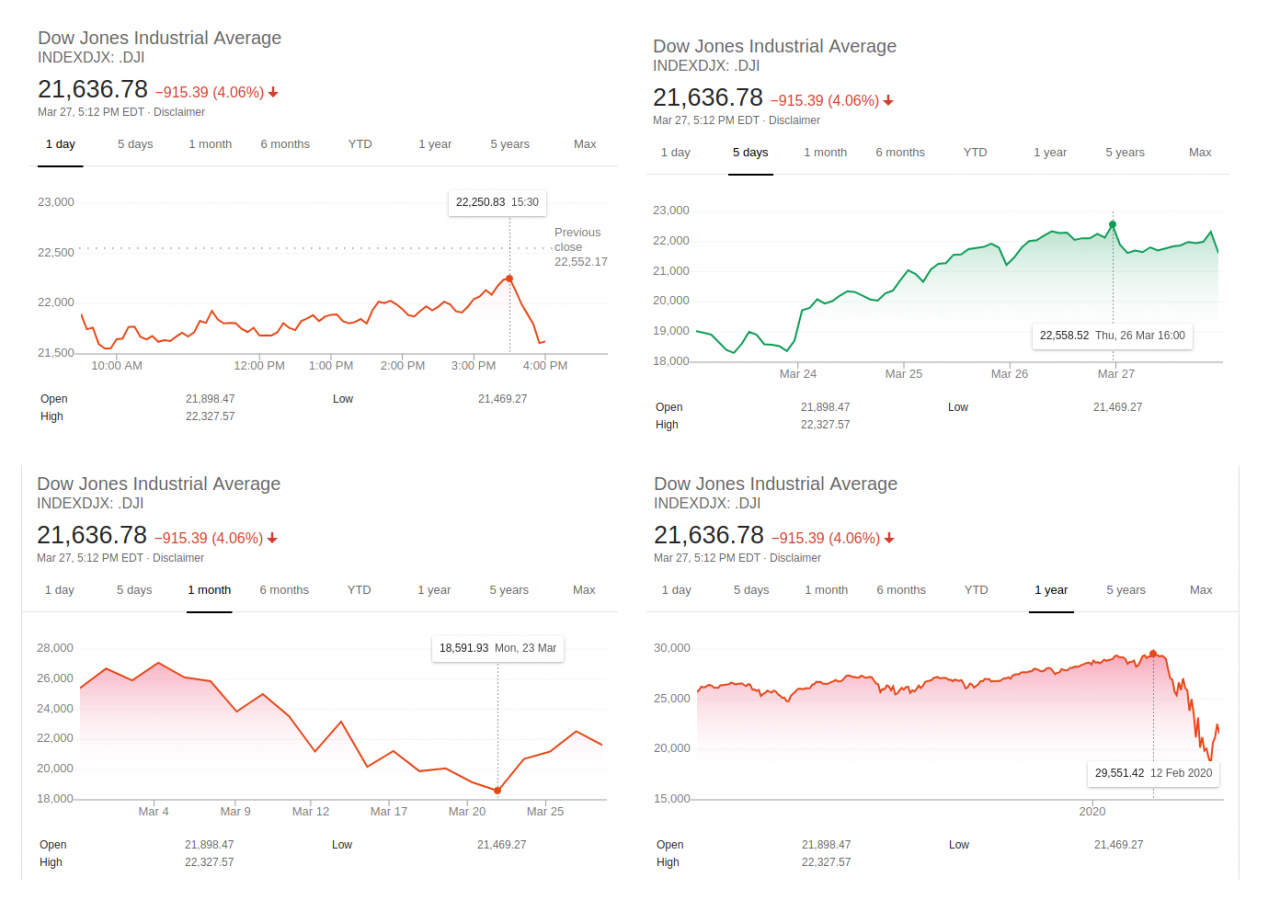

Tuesday March 17 markets up 5%. Most stocks were up. The only ones down of those Im watching are the cruise lines, airlines, etc. Gold mining stocks up. Gold up 3%. Brent down to $29. Bitcoin down.

I suspect real investors might be now getting a handle on the situation, calculating company values and looking into them with consideration of everything going on, and coming to conclusions about what stocks at what prices, and there might be competition among them raising some prices (I mean in general, Im not talking about today's 5% bounce which usually occurs after big drops).

A few people wearing masks in my city today. There are 60 confirmed cases in the country (10 new confirmed cases yesterday in the capital I think) in a dozen cities. Business way down for hotels and stuff. The staff had cups of beer on a shelf this afternoon. Not many people in restaurants. Lots of people in the grocery store. My third day picking up a backpack plus a shopping bag full of non-perishable groceries and cleaning supplies. Some people walking around are wearing masks. Masks are sold out in hardware stores. Some people were selling them from their street vending carts beside their other stuff, but I didn't see N95 on them. Probably just a cloth mask. A few people also wearing gloves. Hand sanitizer appeared on the counters of stores about a week ago I think. Im right downtown, and this concerns me a bit because its not the safest neighborhood, although it has a lot of police. I don't know if that will be changed as there are less tourists here. My main concerns are walking to atms to pay for supplies, getting enough groceries going forward, and getting hurt or killed during a robbery on the street or in my apartment. People in other, calmer neighbourhoods this is probably better. The good thing is people can't eat more than they usually do, so as long as producers can produce and shippers can get the food to the stores, at some point people will have enough food stocked in their houses. The only thing is I don't know how the street people are getting food now that there's so few people around. Is the city giving them packages? Is the church?

One thing is everyone had the flu already when Coronavirus cases became known here. I caught the flu from a friend, and she had the flu for a couple weeks and is just now pretty much better. Im I think near the end of the symptoms, as I had a cough but very mild a couple days ago, then sore-ish lungs, but today I have a scratchy throat, and I don't know if its part of the tail end of the same flu or a new flu. Probably this is what everyone, the vast majority with a March flu and a minority with Coronavirus, are experiencing.

France is saying cases are doubling every 3 days, which is in keeping with the 2-3 reproduction number and the virality early in symptoms (most viral, they seem to think, in the first 3 days or so, less viral after 7 or so days).

There are several (maybe 20 or more, maybe 5 will be developed into vaccines) vaccines in development, as various people have taken various parts of the virus and are trying to use different antigenic components that the immune system could recognize. In the US the first one has entered Phase I testing. That means it's already been tested on animals for toxicity and now it's being tested in healthy people for harmful effects. The next stage would be on a larger group of people to see if they're effective and to continue to test for toxicity.

There's anxiety, which is causing a lot of stress. Loneliness itself is becoming an issue as isolation kicks in.

There's been a run on buying guns in the States. What would maybe be helpful to see would be examples of people doing good, generous, helpful things, and project those images on TV so people will get the idea THAT'S how people are behaving and we might expect they'd then behave that way themselves. Not just images of hospitals in turmoil, grocery stores emptied, people stocking up on commodities and reselling them for profit.

All land and sea ports are closed in the Colombia, in coordination with other South American countries. There is a curfew in some cities. Cartagena extended theirs from 10pm to 4am in the tourist area to 6pm to 4am throughout the whole city. Less nighttime activity might be better, as it's easier to staff the streets with police, and less crime occurs in the daytime. If no one's moving in the night, there are less people entering doors at night (ostensibly for regular reasons), which reduces likelihood of that kind of crime window.

My nephews aren't taking lockdown lightly. They can't see their friends or girlfriend. The family can spend time together, and find things to do in the house or at the river (they live in an small city where nature is quite accessible). It's going to be like that for months.

Wednesday, March 18 the markets went back down over 6%. At one point they hit 7% down triggering the market pause again. Gold mining etc. stocks also down between 2 and 12%. Gold up a little. Brent down 8% to $26. Bitcoin down.

Confirmed cases in all 50 US states. Trump I read a headline is assuming wartime production prerogatives. 500 deaths in Italy today. China 13 new confirmed cases.

New cases may peak in Italy in a few days, according to some experts, now that they've taken social distancing measures.

Huge line in the grocery store this morning so I didn't go in. I've stocked up three small trips, and haven't started to eat that stuff. Found some masks (doubt they're of any quality) in a dollar store where I picked up other needs for if I'm housebound for a while. A rice cooker. Don't have a fridge. Got more cash. Still some people in town (Im right downtown). Stores not closed at all I don't think. Shopkeepers wearing masks often. Noticed there's no tourist tours now, or at least I haven't heard them through my window.

On social media there's tons of post from people I know posting and sharing memes about basically how you shouldn't worry about the event. That's it's like the flu. A few are just starting to change tone a little. In other cases, when someone posts a question referring to the Coronavirus, a ton of people tell them what they think they should do and not answer their question, and a lot of it has to do with how not dangerous it is for you, especially if you're not old. Their posts show how many people especially tourists and foreigners, I suspect even ex-pats since most don't speak the native language, don't know what to do to get tested or who to call.

My PA went out last night with friends to a casino. She told me 'the virus hasn't gone (to her barrio) yet.' I told her people from there commute to all parts of the city, and we probably have between 500 and 1000 infected people if we have 50 confirmed cases (I was wrong about the numbers, which I actually know, but that's not the point), and that if we become a link in the chain that leads to someone's grandson and then to the grandparent and he gets sick, we're responsible. We're culpable. And that even if we aren't the link in the chain but someone else is and we're doing the exact same thing as that person, we're responsible and culpable. I don't preach though, just told her. I'm not sure if you can change people. There are a few million in this city. She takes the bus to and from my place downtown. I gave her one of the masks I picked up. She said it was ugly. Other people I know here are extremely worried about it.

She told me she was worried because from her flu her lungs hurt. They don't anymore. I was relieved to hear that, since my flu is a few days behind hers.

Iran released 85,000 prisoners on temporary release, wearing ankle tags with 300-meter limits from their residence. 50% are security-related (political?) prisoners. They're also taking measures in their jails, they said.

Phillidelphia is now putting off processing people it charges with non-violent crimes. They also might not be able to guarantee due process with court workers off or sick.

UVC (UV light) is an alternative to chemical disinfectants, which wear on surfaces and are supposed to be used in ventilated, hard surfaces, and to work has to be left wet for 4 minutes before being wiped off.

As part of Italy's effort, one small town blanket tested their 3,000 people and stopped new cases.

Putin announced in a televised brief Russia will increase the salary fun for Rospo employees working on identifying the infection, and increase the salaries of primary healthcare workers, etc., anyone in the risk zone. 'These are the people who work directly with those who need our help and support.' He signed an executive order that allows online sales of non-prescription medicines, as well as increasing the responsibility for counterfeit medicines so no one would think about taking advantage of the situation and selling products that cannot cure. He asked officials and telecoms to provide free access from PCs to socially important Russian websites in order to buy medicines, study online, get public services and watch Russian films and children's shows among other things. They were working on new mechanisms to develop smooth cooperation between the government, the Bank of Russia and the provinces. With regards to small businesses, they should receive help in resolving their tax and debt problems, and any penalties should be issued with consideration for the current situation. People who take care of other people (elderly, schools, etc) should be taken care of, and health and security people should be given absolute priority. People must be clear on how to act, where to ask for support, and what precautions to take. We must understand the situation and take care of each other. This is the bottom line under the circumstances.

Who benefits from a lower price in oil is refiners like Velero.

Refinery stocks yeilds: VLO 9%,

Thursday, March 19 market went up 1%, most stocks up I have on my list, some of those refinery stocks up 20% to 30%. Gold stocks up. Are stocks now starting to reflect actual value investment? Gold about the same as yesterday. Brent up 1% to $28. Bitcoin up to $6200.

People still socializing a lot.

In my city more people are wearing masks today. Maybe 10% 20%, it's hard to notice really. I found a place that had 6 types of masks, including N95s. My PA will probably not wear the one I gave her on her bus ride home and back here. I think some hotels will be used as hospital facilities? In the UK hotels will be used for hospital staff as a sort of quarantine for health care workers. Less people on the streets but still some.

Apparently in my city a quarantine begins Saturday. Only allowed out for food etc. I don't know which places will remain open or closed. There will be 4 people in my hotel who basically live there. In my apartment it's almost full I think.

Verizon said web traffic was up 20%, and social media was flat. Gaming up 70%, streaming video up 12%, and VPNs (people working from home) up 34%.

Save-On Foods is going to have a designated "seniors" hour, amid reduced hours.

Friday March 20 on reddit the top post was 'What is one thing that could realistically happen in 2020 that would make things worse?' and the top answers (each one given several times over, and upvoted several thousand times each) were a hurricane or earthquake, a solar flare, and that the government would end internet privacy with the bill they're working on passing. Although strong government (Putin's Russia, not as far as Xi's China I don't think) is useful in many things, including providing what people look for and can rely on in troubled times, and purpose and stimulus in peaceful times, at least when the leader is a competent person like Putin, the ability to pass motions against people and human rights is easier. Even if another system is superior to North America's electorate 'democracy,' democracy should be used for laws still. Leadership should be for providing leadership. (I guess I don't believe in government for 'government' of people. Public institutions should provide organizing services, but this shouldn't be considered government.)

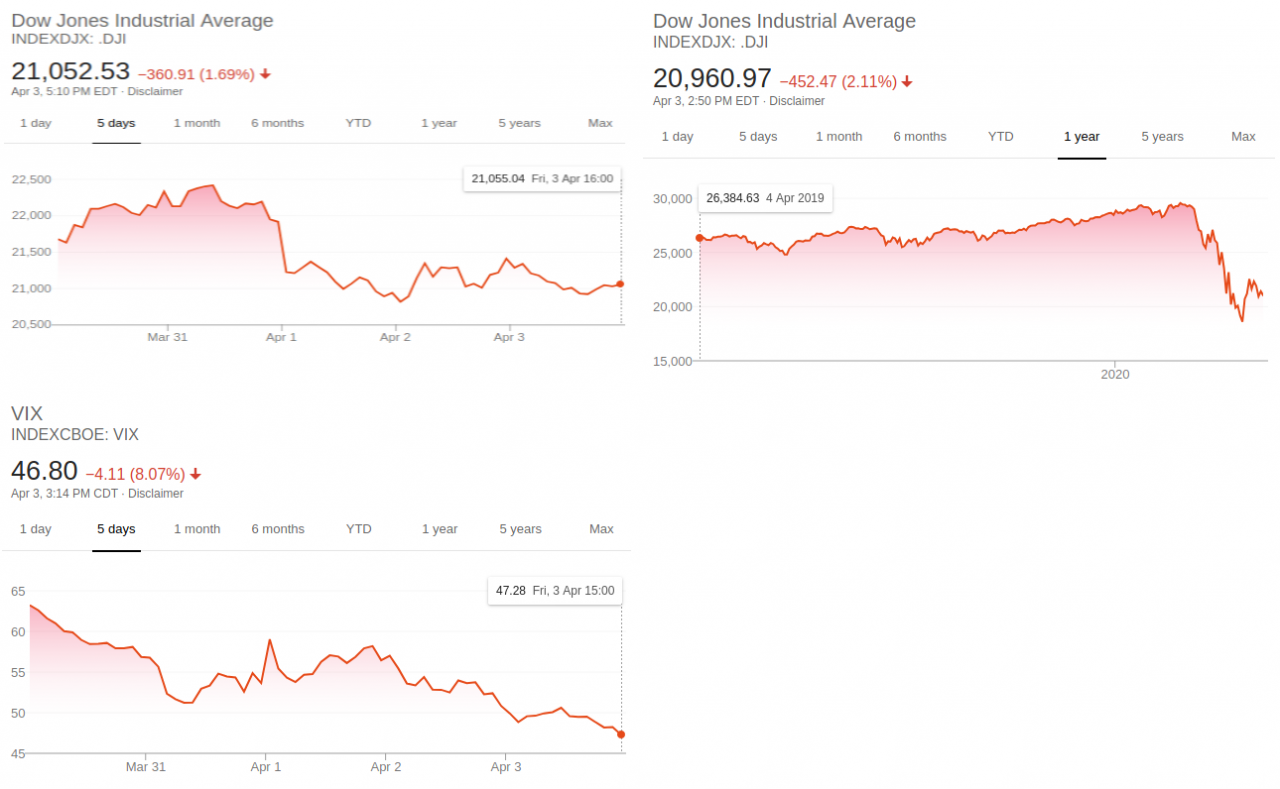

Dow was basically up a percent or two until around 11, then went down, closing around 5% down. Those refinery stocks are all up though basically. Some stocks are up, some down. The gold stocks are mostly down. Gold went up 1%. Brent went down a few percent to $27.

My city started it's quarantine tonight, actually one minute ago, at 7pm. It goes until Tuesday morning. Everyone in doors. I think it's just life-sustaining businesses are open, like grocery stores, pharmacies, transport services, delivery of food, and I guess hotels. I did some shopping with my PA today. We both wore masks the whole time. She wore her cloth blue one (she said she's wear the n-95 one I gave her once the Coronavirus makes it to the area). Picked up one more trip of groceries in the morning, and some boxes.

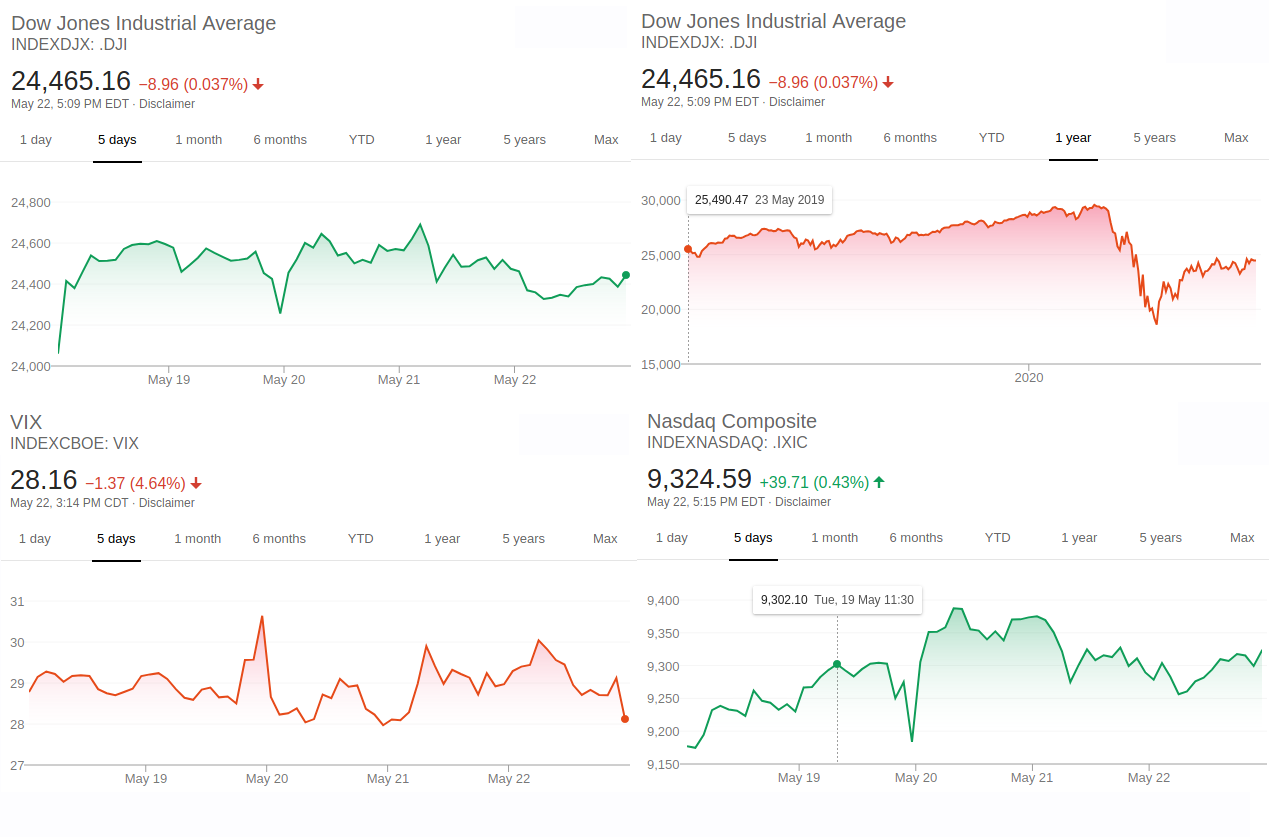

Monday, March 23 the markets went down 3%, but it looks like most of the stocks I have on my list went up. Seems like investors are buying in now at what they consider low prices for the stocks. Gold up less than 1%. Brent up to $28. Bitcoin up to $6630. It might be a good time to buy in, given the temporary nature of the event, but I don't think I'll really look into stocks for a bit, and I'm not sure confidence might go down again.

Our city extended its quarantine to Tuesday night when the national quarantine begins. Scheduled to April 13 so far (2 weeks).

Haven't really been keeping up on news with how things are progressing, since the city's been pretty quiet and I can actually work on things I care more about, which is something extremely rare. I'd like to read it, but I don't think I'll have time to write it, that being the sort of thing I usually do, but do because it's too noisy to work on anything that requires concentration.

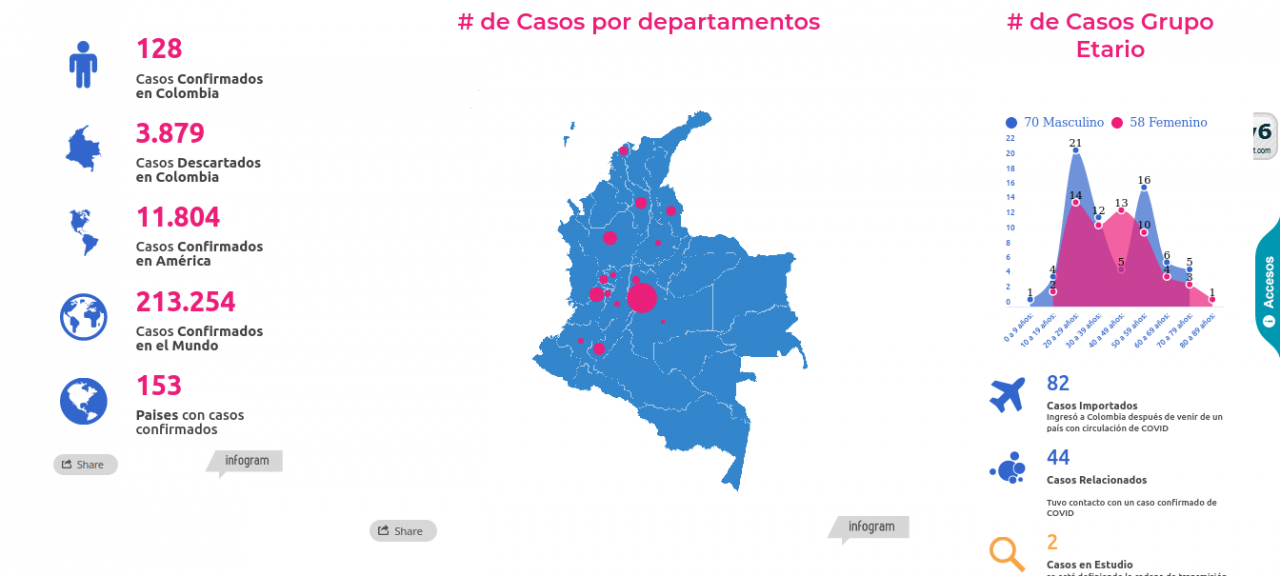

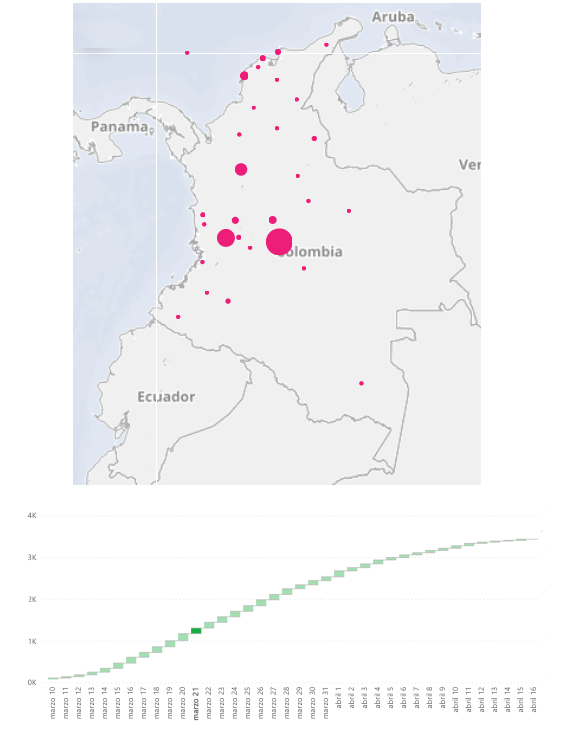

An image of what the country's website for the Coronavirus looks like:

A stock that went down like the rest, but since March 16 has climbed pretty steadily back up is NFLX. Village Super Market has done well since March 12. Sprouts Farmers also, although is went down 6% today. Teladoc Health since the 17th. Ring Central since the 16th. Zoom since the 16th, dramatically. Everything else has either stayed down or has fluctuated. Pretty early on making any decisions based on even these few gainers though.

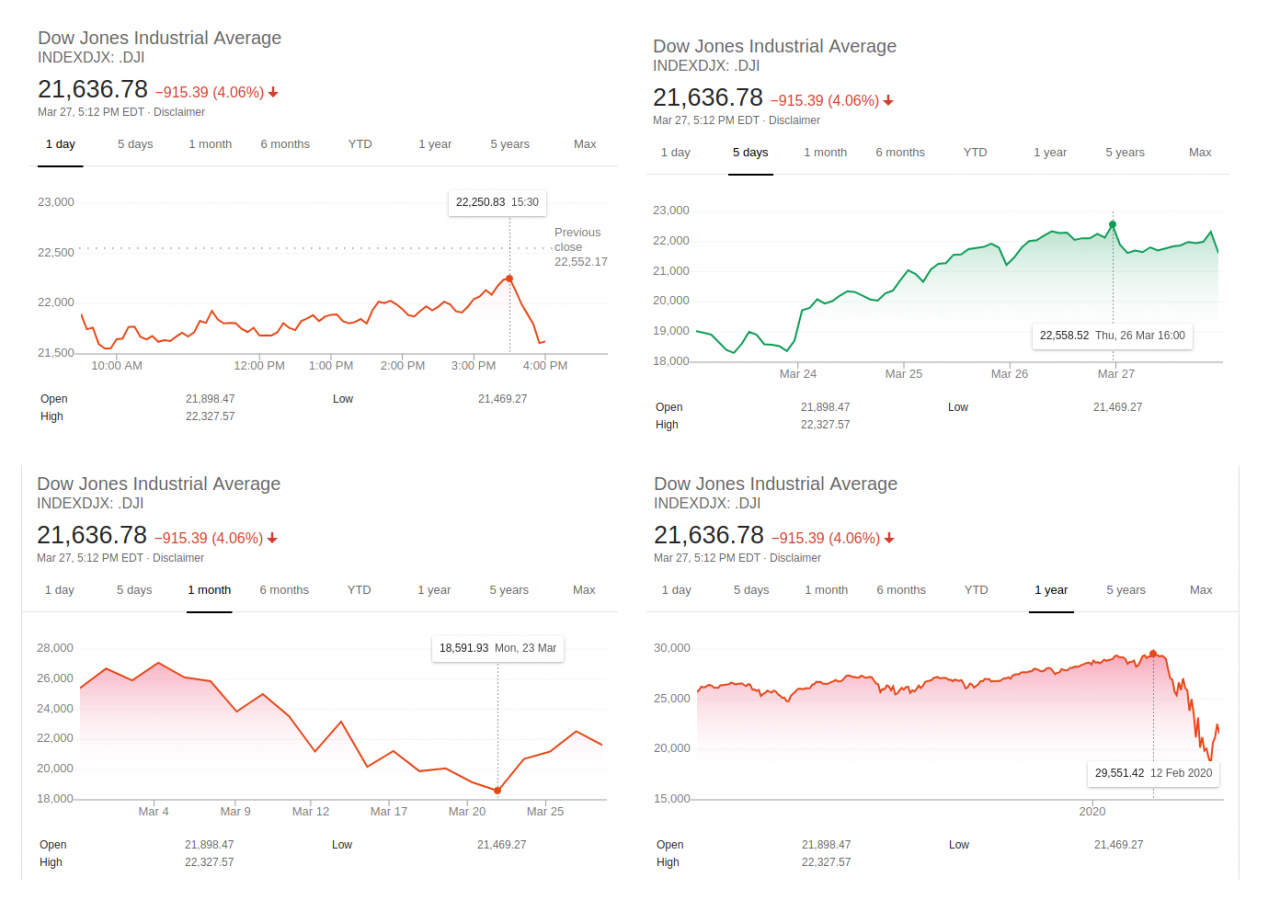

Tuesday, March 24 DOW up 11% (biggest gain since 1933 Depression). Basically all stocks up, including the ones that had gone down the most (cruise ships, airlines). Does this have to do with the President's comment yesterday that people would be ok to go back to work Monday? Analysts say its because the US stimulus bill is nearing (6t, 2t direct assistance and 4t in Federal Reserve lending power). Most commenters are not thinking there is a bottom yet, despite the day's gains.

I don't understand the position the US government is taking, unless it's strictly economic ie to just go through it and come out on the other side in a few months in a stronger position due to having less older people (which of course don't create goods and services, but cost money for a State), as well as the money they have saved transferred to new hands to spend or invest, plus the death tax the government takes from the transaction (if I remember correctly). Houses and properties would also change hands, which includes money to government also. They would also be in a strong position relative to other countries who care more about keeping their grandparents and will have tried to limit the virus spread. This may not be what they're thinking. I don't know what the US government is thinking here.

The streets were busy outside today. I think it was that the people didn't know that the quarantine was changed a couple days ago. It was originally to end today and there'd be today with no quarantine until tonight when the national quarantine begins. The state government changed this to extend to tonight the local quarantine when the state one kicks in. There were lots of people out today. Some shops opened (and then closed pretty soon). Then there were lines of people I think signing up for aid or something. No one was doing social distancing. Actually maybe I did see a few people doing it, in masks too. Most masks here are just cloth masks that look like hospital masks (they're blue), and I don't think have any type of filters.

In Wuhan, from lockdown to peak number of cases was 6 weeks, and hospitalizations increased after that for 4 more weeks.

There wasn't in the US national strategic stockpile was they ended up needing. Importing medical devices from other countries will be stopped at the border, even N-95 masks. Some talk of exercising discretion on that for a couple months (talk among commenters).

Some companies may be long-term beneficiaries besides Zoom, like Chipolte for delivery and other fast food. Lowe's and other home improvement retailers, considered part of the critical retail infrastructure of the country because they need to be kept open in order to keep society functioning. A lot of businesses continue like health care, telecom, utilities, many tech businesses. Restaurants can continue to deliver and have pick up.

Some people think the recession will be worse than 2008.

Wednesday March 25 and the DOW went up over 2%, the first time it's gone up two days in a row since it started falling. Most of the stocks I've been watching up, including cruise lines and things for the second day with big percentage gains. Gold stocks half up half down. Some of the stocks that had fared well during the past few weeks like semicons and software down a bit. Gold down a percent. Brent about the same.

Drug research is going through international trials, ie several countries at once. Remdesivir the Ebola drug, Chloroquine the Malaria drug, and a few others, in various combinations.

In Italy, new cases still but the percentages of new cases is going down. Many of the new deaths contracted Coronavirus before the lockdown.

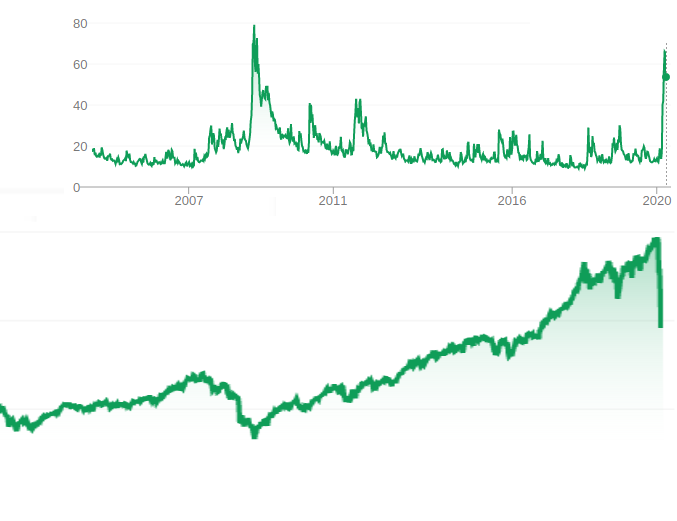

Thursday March 26 the third day the markets went up, the DOW up over 6%, and futures went up also today after going down the last while. The DOW is up 21% in 3 days. Despite a joblessness report with between 3 - 4 million people this week, the highest ever by far. For the past decades, it's gone between 250k and 750k, often spiking to around 500k. The 2008 Recession was like that too, the worst week had 650k. Now there's a straight line straight up to 3.5m.

Analysts are calling it the liquidity rally then the rebalancing, as a stage 1. Stage 2 might be the economic buffer, the question is if the relief package is going to be enough.

Gold down over a percent. Brent still around $27. Bitcoin at $6800. Most stocks I'm watching up. Cruise lines went down 5 or 7 percent though. Gold stocks mix of up and down.

US government has indicted Venezuelan PM Maduro of narcoterrorism conspiracy, drug trafficking, and corruption. A Venezuelan official called the US's action a 'new form of coup d'etat based on miserable, vulgar and unfounded accusations.' The US government offered a cash reward of up to $15m info leading to the arrest and conviction of the Venezuelan leader and other high ranking officials it has accused of being what the US government calls 'The Cartel of the Suns' who the US government says is colluding with a dissident faction of the demobilized Colombian armed FARC group 'to flood the US with cocaine.' Maduro has been the target of US sanctions since 2013 and US efforts to push him from power. The US and some other countries recognize instead of Maduro the opposition leader as the 'legitimate president.' The US government also offers $10m for info leading to the arrest of Venezuela's chief justice of the supreme court.

Venezuela has the largest proven oil reserves in the world, approximately 300b barrels. The Orinoco Belt is estimated to contain 900-1400b barrels of heaby crude (400-600b technically recoverable). In 2010 Venezueal produced 3.1m barrels and exported 2.4m of them per day.

Reportedly, Maduro has recently been turning over control of oil production to foreign firms to maintain control. I don't know the details.

Apparently, people who want to go to South Africa to help out can't because paperwork is tough (government).

New York has built an emergency hospital in a conference center. A Mercy ship is on its way to LA I think, or NY, with around 1000 beds. LA expects to need 3000 - 30,000 beds. Florida has not shut down. The US has 300,000 available beds or a total of 900,000 in its hospitals (3 beds per 1000 people, compared with 12 and 13 for Korea and Japan, the most in the world per 1000).

Friday, March 27 and the markets basically went up until shortly before close and then people sold lower, which is actually what commenters were talking about yesterday, that there was some room to go up at least for part of the day. Basically all stocks went down a couple percent on my list. The cruise lines and other companies affected most, which had gone up during the week, went down a lot, like 10 or 20 percent again. All the gold stocks went down. Situation up stocks, like Zoom and Ringcentral, went up, at least a couple of them, which I think some of these had gone down during the week while other stocks went up. Gold went up a little. Brent still around $28. Bitcoin dropped around $300 to $6300. Some investors were going in yesterday and before into the market, others were noting how every drop like this that had a rebound was retested later to new lows except like one. I personally can't understand how anyone would want to tie money up in stocks at this point knowing they could go down and stay down for quite a while. If I had an algo that would test pressures I would use it though in the fluctuating market.

Trump signed the $2b stimulus bill. The total value of the package is I think $7b, half in loans. There might be an issue coming up in popular discontent with the issue of debt growth in companies and buying back stock. Some say policy makers encouraged this in their laws as a way to drive up market prices. Airlines, the industry, not a specific company, for example, bought back stock $45b over the last decade and now the industry wants a $50b bailout program. Programs might 'have to' expand to bail out hotels, car rental companies, energy companies and others, citizens might be unhappy with Washington.

Another issue might be mortgage REITs. Some have lost 80% of their value in the last month. These particular funding companies invest not in mortgage properties but in mortgage bonds, and they buy these bonds on margin (the borrow to buy them). When the value of them starts to go down, margin calls happen. They have to sell, and when they have to sell, other REITS might have to sell also. Some similar mortgage REITs have done better, the ones that invest in government-backed mortgage bonds. It puts pressure also on banks and individual investors, many of which are looking towards retirement income. I don't really understand this issue. The federal reserve is pumping money daily into residential agency mortgage backed bonds and that is helping some of the mortage REIT companies. Debt servicers face a problem in that they still have to pay their investors and MBS, while the big US ones have all announced forbearance programs so borrowers can delay monthly payments. They've asked the fed for some kind of liquidity line to pay investors.

Ventilators are not abundant. Some companies are ramping up production, Ventech from 100 to 1000 per month, and companies are going to be allowed to modify production models without the same checking regulations. Automakers and vacuum makers are repurposing factories in the UK and US. States are competing with other states, it's been reported, and dealing with price-gouging. Counties, cities and hospitals are doing these things on their own in the US, rather than the federal government organizing things. Auto-makers have their own conventional shops where they make their own tooling and prototype parts, manned by highly skilled workers who can read drawings, read computer print outs, and make things.

There are over 100 small parts that go into a ventilator. These parts are also a limited global supply. And some are intellectual property.

A ventilator is a complicated machine, which has a complicated sensing process to tell how much pressure and how much volume to put into the lungs of a conscious or unconscious patient to give enough oxygen but not to damage lungs by expanding them too much. The process of producing one is usually tightly regulated. They cost $25,000 for a basic model to $50,000 for an intensive care unit ones, which hospitals particularly smaller hospitals can't afford them without becoming bankrupt, and what will they do with them afterwards. In the hospital, ventilators generally require a trained medical team, a respiratory therapist, a nurse and some kind of doctor that's usually a pulmonologist. I don't know if really these people are actually necessary to provide ventilation though. People are looking at how to gerry rig them to use for more than one person, or using people to manually ventilate patients, such as was done in the 1952 Polio crisis by medical student volunteers and is done in poorer countries.

NY said they need 18,000 ventilators. The ventilation treatments in the UK are for 2 weeks.

People are developing and producing alternatives to the ventilators we have in our hospitals though. There's one some Indians developed that uses and Android phone and a small machine which sells for I think around $600. Another one was put together, also small, but uses its own circuitboard and not a phone. Mercedes F1 is also reportedly going to mass produce CPAP breathing units, which assist a person through negative pressure,.

The kits being imported from South Korea to LA cost $60, and LA county is going to buy 100,000 per week, cheaper than the WHO $150 ones, and the next type might be under $10. It's estimated a few billion will be needed.

Some authorities have been saying tests aren't needed because it's in the community, but this doesn't make sense to me because since most people don't know they have it, only with testing would you know who should be isolated for 2 weeks and who you can still spend time with. If you get tested, you can go and see your family and know you're not going to infect them.

Wuhan temporary hospital

There might be a theraputic by the summer. Convalescent plasma (from people who have recovered and put into people who are sick) is having a theraputic benefit, which comports with what we know of convalescent plasma in this setting, it was used in H1N1 and Spanish Flu with theraputic benefits. This means monoclone antibodies can also work in this setting, they think, like Regeneron's project, and there might be hundreds of thousands of doses made by them in the summer.

Around 3b people are on lock down, including all of India's 1.3b.

An island off the coast of an Australian city has reportedly been converted into a sort of isolation island.

In Korea, where the situation has been handled as well as any place except China (where stricter measures are complied with the by population perhaps), 30% of new cases are people in their 20s. This may be because people of that age worry less about their own mortality and continue to go out to Gangnam, restaurants, internet cafes, and other places where they're packed in tight. Another 20% of new cases come in from international flights. (My source is from the 24th though).

The reason the WHO might be advising normal people not wear masks (although reportedly they advise people in Asia to wear them due to cultural differences) is that there aren't enough masks and they don't want to be out of them when health care providers still need them. Europe and the US were unprepared in the way Korea, and they mark it down to perhaps their experience with the half dozen new infectious diseases over the past 20 years including MERS in which only Korea was affected really outside of the Middle East, and knowing they have to contain viruses, have to wash hands and wear masks.

In Korea, the test costs $140 and takes 6 hours, but because there are so many done, 13,000 a day, people are held in an isolated room until the next day to get results. People who want to pay for a test (who don't have symptoms) are reimbursed the cost if they test positive.

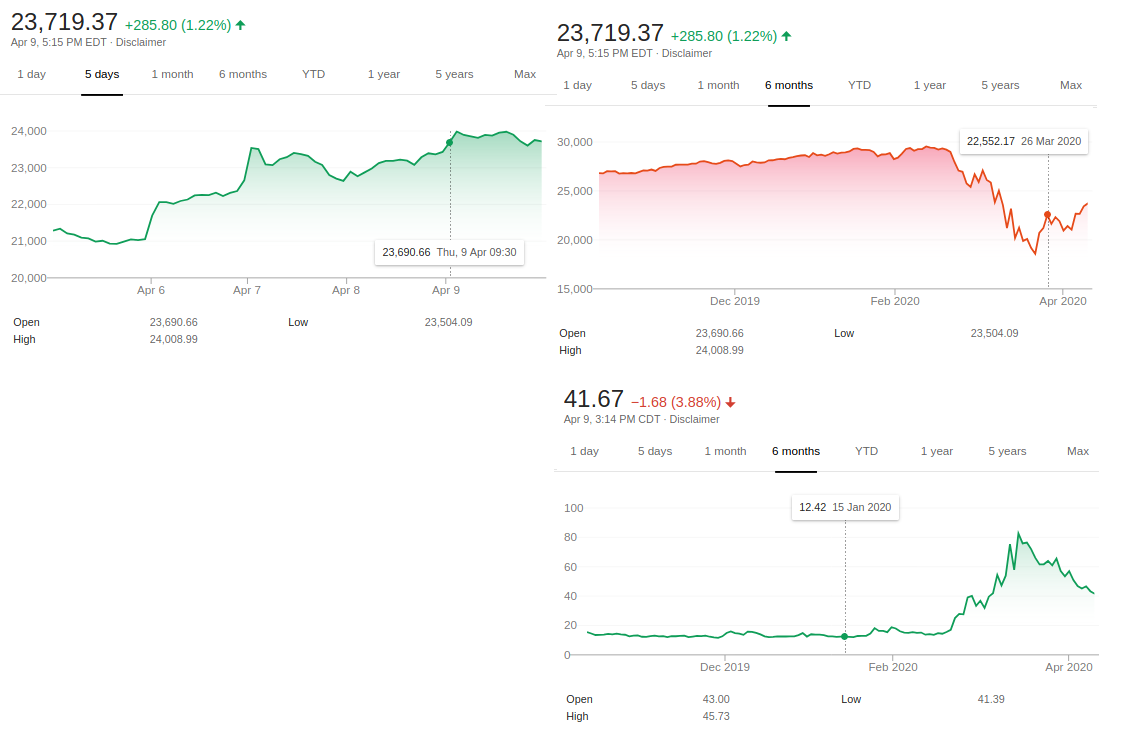

Monday, March 30 the market went up 3%. Bitcoin up. Brent down to $23. Gold just down a bit. Economists think there's a bottom now, but maybe not THE bottom. In 2001, 2002 and 2008 there were two rallies of 20% for each one that failed. They think what is missing is TIME, because we have worse economic data to see. Markets are looking right past that. Is that amazing? Energy stocks and cruise lines went down, about 10% for cruise lines. I'll probably buy into them. Later I bought Norwegian and Carnival for the open and would have bought Caribbean but something funny happened with a previous trade. I tried calling my broker, TD waterhouse, and perhaps it was just something with the platform, and the platform generally sucks and has for a long time. When I tried calling them I waited an hour and 20 minutes before I gave up. Staffing, the message said. The stocks went up on opening, and went up like 10 and 20 percent and I thought that was perhaps too high so sold them. They went down to up around 2 and 3 percent for the day at close, although I'm not sure about those numbers because it looked like they might have closed up a bit more than that. If they'd gone down all day I would've I think held them and been long on them for the next couple years. I'd buy into them again if there are new lows.

New York (a charity there is funding I take it) a field hospital in Central Park. The charity has been operating a similar hospital outside of Milan for over a week.

Apparently, someone stole a van Gogh from the Louvre or some museum.

Tuesday March 31 the markets were up a percent or two this morning but closed 2% down. The VIX went down although still in the 50s which is relatively very high. Brent the same. Gold the same. Equities behaved seemingly normally though, and so did bonds and the credit market. Analyists are wondering whether there will be a re-test in the coming month that will bring new lows. Some are weighing in for yes or no. No one is certain about anything. Some cmmenters think that some businesses will do well because they will emerge at some point in a better market position, while companies with less strong books will not make it, so better to not invest in the indexes but instead specifically in businesses that won't go bankrupt.

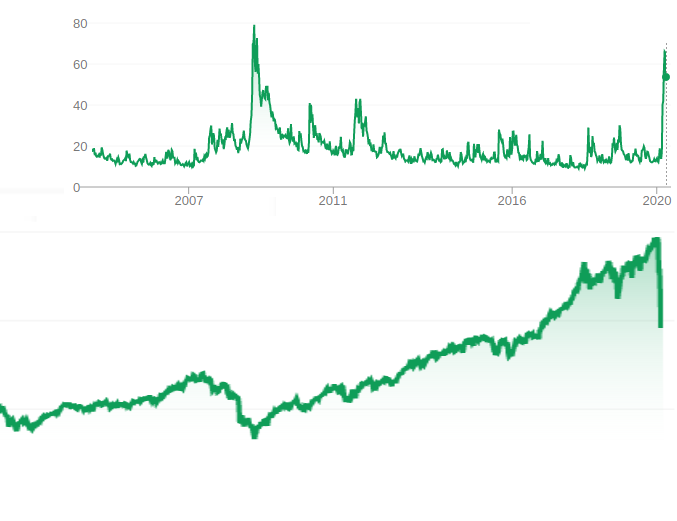

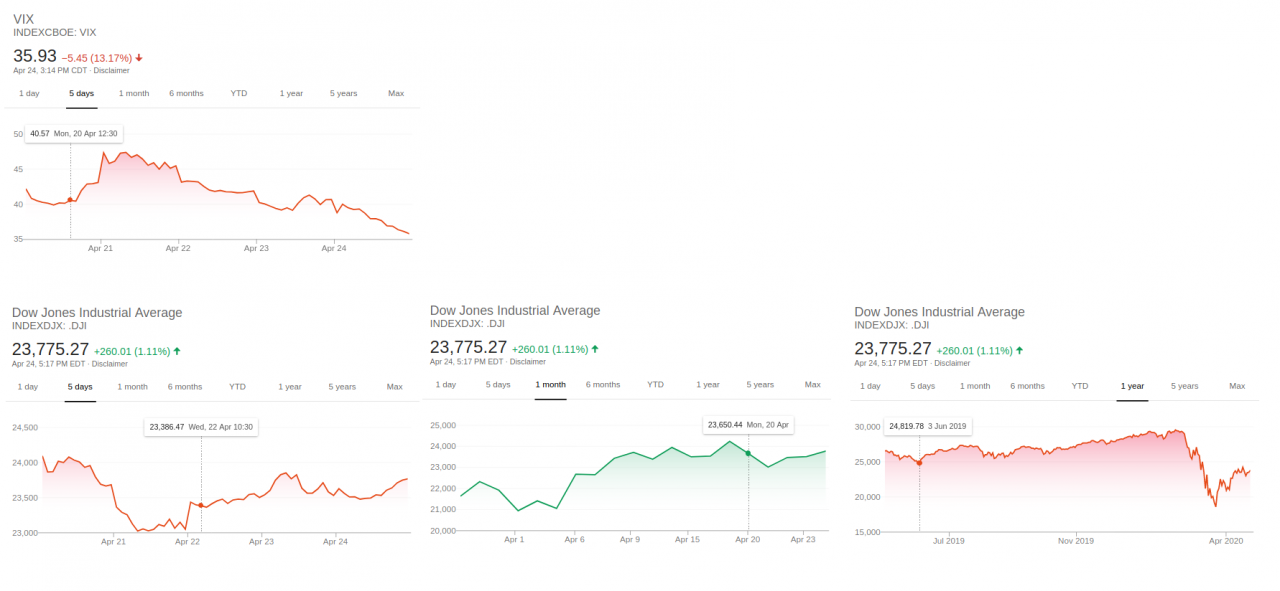

VIX and DOW

There were a lot more people out and about downtown today from the morning. However some people, including Venezuelans, were detained for a bit for being out, including someone I half-know, but were let go instead of having to stay 12 hours in the truck.

New cases in America rising partly because they're testing a lot more. Italy is 23 days into lockdown and new infections are down but still at under 8%, perhaps because there was already so much community spread before lockdown started. Countries that had less community spread before lockdown might have a quicker reaction.

Reportedly, there is internal migrant crowding in India as people try to return to their home villages.

Recently people were allowed to leave Wuhan but it seems there was a barricade not allowing them over a bridge by a neighbouring location. I don't know if this is true. News about China is unreliable on either side. The government censors any official news, while anti-China entities push fake China news to make it look bad, such as using videos from other events and relabelling them to make them look like things happening with current events. So there are no reliable news sources on China period. If someone wanted to be one, they would be either hired and converted by the government or silenced.

People expect a baby boom in December.

A report has it that in US care homes, the fatality rate is 34%.

A question coming up is whether the West can or should use things like the tracking and monitoring apps China and Korea used and use with success against the pandemic. For Westerners this is anathema, but I think it's not the measure itself (well, in part) but also they rightly don't trust the government with that information, nor any organization with it. It would be different if privacy and security was reliably (totally reliably and tested) baked into the system. Currently there aren't any countries where the people trust or can trust their country's government, maybe that is something that will happen in the future. We're improving on some things, like the current recession would be worse if nations like the US and I think some European nations (Canada already had good banking regulations from what I've heard) hadn't improved their banking systems since the 2008 09 recession. Due to that, the banks have strict regulations for everything, protocols for if this happens you do this, and the banks are in really good shape with good books. So are a lot of big companies. We can avoid or mitigate many problems in the current situation because we have strong banks in many countries. Due to this, the current issue is a liquidity issue, not a real credit issue. People are not going to make their credit commitments like mortgages, but it's because the whole country is shut down, and what they need is a time out of 90 days or so, where the mortgage they don't pay there will be tacked on the end of their payment schedule instead. After all, those people are people the credit institutions did business with, wanted to do business with. The main people with something at risk in this recession are owners, small medium and large.

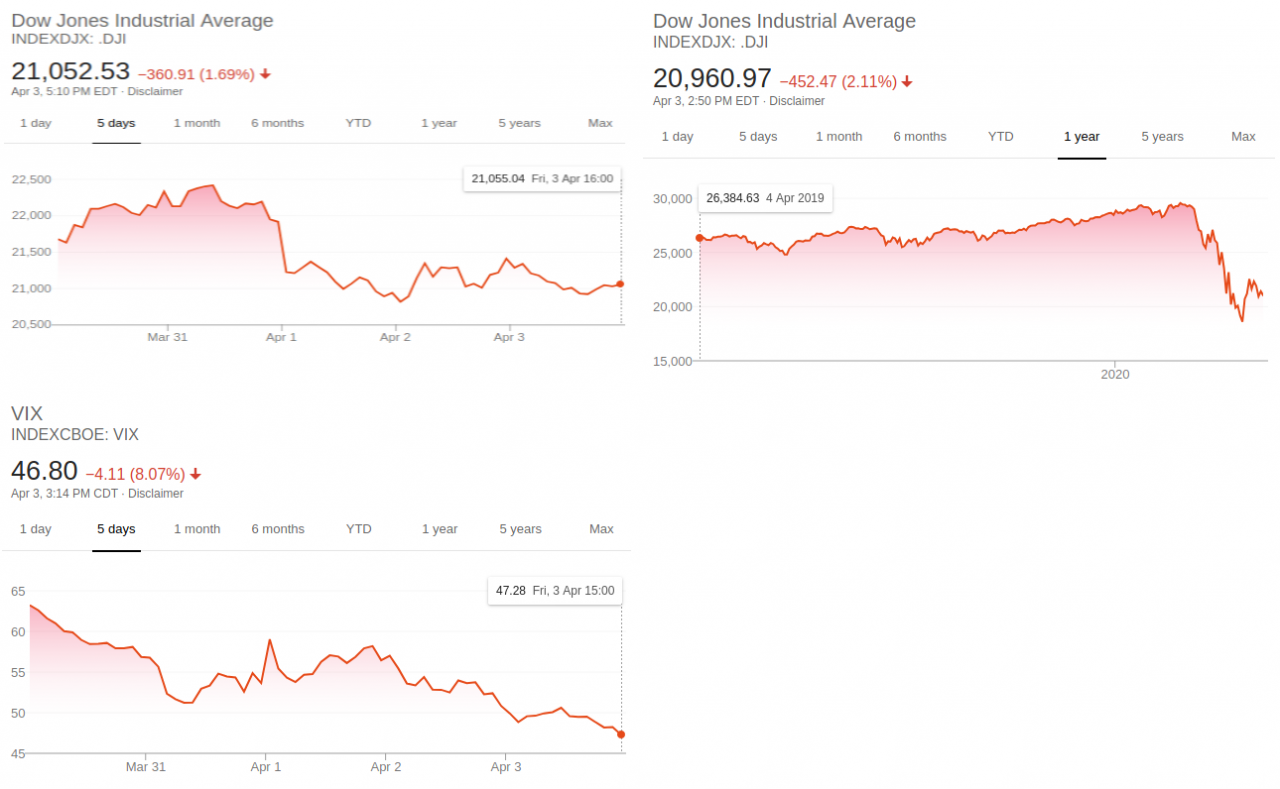

Wednesday April 1 DOW went up a bit until around 11 but closed down 4%. Most stocks down. Affected companies were the most down. Gold the same. Brent the same at $26. Bitcoin at $6600.

Belgium you can go out multiple times per day as long as you are 'on the move.'

Australia masks are mandatory for shopping.

Thailand seems to have a new finger-prick test. A small piece like a pregnancy test, where you put a drop of blood on one part, and you see one line if you don't have the virus, two if you do have the virus. A faint second line if your body is already producing antibodies.

Commenters say the public is more optimistic than the timeline that is likely. So far people apparently think there can be a timeline, and its not too far away, and that it won't be too painful, too costly, to get to. Some are thinking about it as a repositioning opportunity, where even though your stocks might be down, so are other stocks, and you can sell ones that have no or insignificant cash reserves, that is very negative in cash flow, if it has a lot of debt. The bailouts that will come may come and also underline the capital structure of a company, and most of the bailouts might come with conditions. A diversified portfolio of value. Resistance zones, bear market rallies. Bear markets produce enticing rallies. In the Great Depression 86% of value was lost over 33 months but there were 8 rallies in the S&P that averaged 24% and these kept bringing investors back in, thinking it was over when the drops were 33% on average. Stocks are still 30% over valuation to the average. Not even to the lows. To get to the average market cap to GDP ratio the stock market has to go down 30%, and if GDP is going to be revised 10% or 20% lower the market needs to go down more to meet it, but because interest rates are lower so the multiple should bottom out at a higher level, but that's complicated by the fact low interest rates are hurting certain industries like banking so maybe it should be even worse not better, like it is in Europe with their negative interest rates. It might go down 50% to be oversold but that would take time.

The US treasury secretary is talking about investing in infrastructure.

Applications for new mortgages fell 20% last week compared to last year. Mortgage interest rates are at lows, so people are taking advantage and buying properties online.

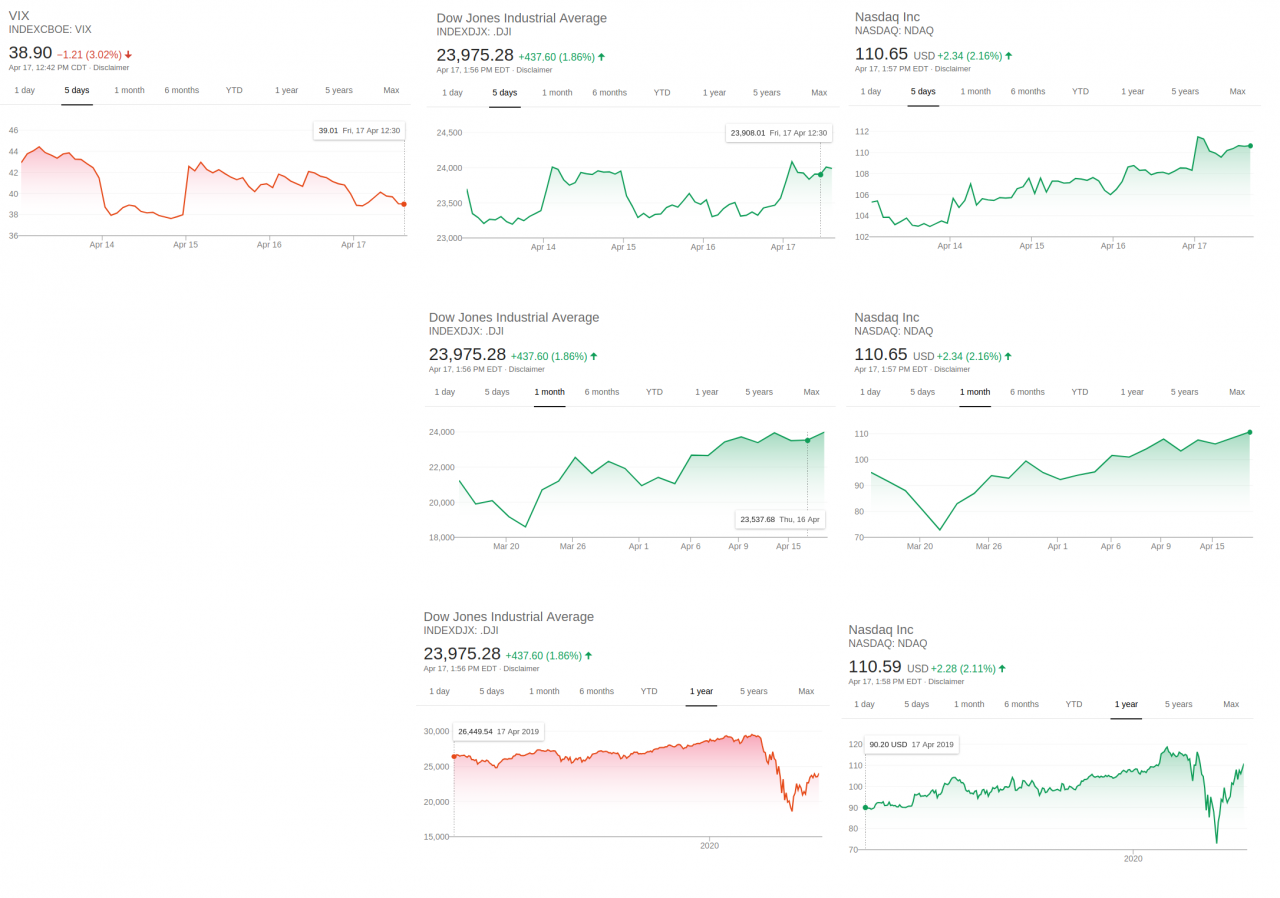

Thursday April 2 the US unemployment claims doubled to 7m. Some expect 60m jobless before the story is told. The DOW went up 2% after being down a couple percent early in the morning. Stocks half up half down. Gold up 2%. Brent went up to $30. Bitcoin up to $6800.

OIl has to be $23 to keep current drills open. $49 - 55 to entice profits. One company filed for bankruptcy this week. Expected to be a number of dominoes falling over the next couple of years due to balance sheets. According to some analysts low oil prices is not good because economic growth drives commodity prices, not the other way around. A low price in oil or copper or aluminum means there is some economic hardship in the future.

Friday April 3 It seems Sweden is taking a different approach than the rest of Europe to Coronavirus, where schools and shopping centers are open etc.

Trump has invoked the Defence Production Act and requested 3M, a company that makes masks and respirators and things, based in Minnesota but producing some masks in China and some respirators in the US, to turn up imports of masks, which 3M did, but also to divert respirators for Canada and Latin America. 3M published a note on this saying doing such would represent humanitarian issues because they are a critical supplier of respirators to those countries, and also that those countries and maybe others would retaliate by making less respirators available to the US. Trump tweeted a threatening tweet about 3M in response.

Aircraft account for 7% of global greenhouse gas emissions, but companies like Lufthansa have cut about 90% of flights. Big ones are bleeding $60m per day, smaller ones $10m. An industry very cyclical and macro-dependent.

Hotels are also down 90%.

The leader of the White House task force on Coronavirus has been receiving death threats and is beefing up his security.

Some countries are organizing special flights to return citizens to their home countries.

After the virus, the previous trend to densification in space may reverse, some realty experts say, towards more space, two shifts, working from home more like they are now, maybe not wanting to live in the city where currently it has been the most popular, especially the 'capital of the world' NY and LA, everyone has moved towards the cities for decades, and people and companies might still be thinking about the next virus and want to live and operate with more space. More space in their apartments, more space outdoors, air quality, the type of construction materials used.

Markets looking fairly normal in terms of behavior. Brent went up 17% to $35. Gold about the same.

Morgan Stanley is now thinking there won't be a strong rebound in Q3, and activity won't return to pre-Coronavirus levels until the end of 2021.

Some commentators are thinking of Amazon and Microsoft as infrastructure plays. They're how we're getting by right now.

They say it will be a bad year for earnings, down 30%, and companies can basically throw all their bad stuff into this year, making a real decline in earnings with something to blame it on, and then in 2021 go with a clean slate towards a typically strong earnings recovery coming out of a recession.

Shortsellers are looking at companies that because they don't have solid business models they won't come out of this looking very good, that lost money in 2019 and are going to lose more money in 2020 and might not make money in 2021, but are still priced at a premium based on 2021.

One of the business models that might be exposed in 2020 are restaurant brands like Wendy's, Dunkin' and QSR, which are essentially franchisers to business owners who are highly leveraged with some Chapter 11s in the months before March, and who also lease real estate to their franchises, and who also bought back a lot of stock at highs, and so are triple leveraged you might say. One of the dark sides of the buyback boom. Another is the gig economy, which might have a very big labor pool coming out of this recession, where their unemployment as independent contractors is payed by taxes rather than companies that would have paid into benefits pools. Labor relations.

In bull markets and recessions fraudulent operators are discovered, and the second wave after the initial shock of people selling off stocks is realizing some companies that seemed great weren't actually performing magic. In a long bull market people's sense of disbelief is reduced. Also cheap capital is available. Chinese companies too.

Relations might get worse between the US and China. Corporate supply chains and reliance on imported products that are essential to well being and national security.

No clear path with oil situation, some think it's worse than the 70s crisis. Some are better positioned to survive with a dividend for 12-18 months, like Total, Equinor and Galt, compared to ones that might not like Shell, Rexhall and MV.

Saturday the US and Canada are now advising wearing non-medical masks. The chief US guy on this is now using the word aerosolization, that people can spread the virus by talking, and it can remain in the air a while, and that people can spread it asymptomatically.

The UK released some prisoners early.

Some tests are giving false negatives because they're not very accurate, so doctors are advised to diagnose by clinical diagnosis instead in the UK.

Alternative news seems to be hard questioning their support for the WHO and other global organizations, which ones they can be part of, which they can influence to change, and how much they remake their sovereignty, and how they've allowed 30 years of globalization and identity politics to take away from the country's national interest.

With the WHO, which every nation pays into, which has been criticizing Western countries and praising China, saying there's no interpersonal transmission going on in China, is being questioned because of the influence of China on it, and is being called a joke.

An epidemiologist for the WHO has recently been singing praises of China in news broadcasts was recently asked about whether the WHO should consider Taiwan's membership and he stalled for 10 seconds, then said he didn't hear it, and when the reporter said she would ask it again, he said 'No that's OK let's move to another one then.' She said she was actually curious about Taiwan, about Taiwan's case and the line was dropped. They called back and asked how Taiwan had done on controlling Coronavirus, and he said ' Well we've already talked about China.' A Japanese politician also recently made statements about this, and Trump also signed the second US contract with Taipei that uses the word 'Taiwan.'

The UN is also considered by the same people corrupted. A lot of these criticisms point in large part to China specifically.

According to some analysts, Russia wants to damage US shale, even if not bankrupting it, making it less globally significant in terms of supply-demand imbalances. Saudi wants to hurt Russia for agreeing to the 2016 OPEC agreement, where Russia hasn't cut back on production. It has only cut production flat. Russia also hasn't followed through with planned investments in SA, reportedly.

I'm really curious what the US can do to retaliate against Russia and SA.

Sunday the psychology of this state of society, which may last 3 months, and how are people going to get by? it makes a person really kind of angry. One of the things available for anger is the inefficient responses of the government, although it depends as much on the citizenry who are no more responsible. If everyone was serious for 3 weeks, society could return to normal. We're in our third week of lockdown, scheduled to end in about a week from now, but it can't and most likely won't. America and Russia have already extended theirs till the beginning of May. A three month lockdown puts us in June. People may get angry and start blaming people for this misfortune. The obvious target is China, but fairly no country I've seen has been any more proactive and responsible, nor set about coordinating sustenance and caretaking measures for the period of lockdown. People on the streets cursing China and other countries, while not wearing masks and sitting around with other people. I think a lot of people, having experienced a few weeks of lockdown and presuming another 3 months, might be weighing the odds of simply behaving as normal and getting the virus, although we can't, because it's too risky for old people and even for people of all ages.

In Colombia, there are hundreds of thousands of Venezuelans who decided to come because it seems better than in Venezuela, where life is dire for many. It's more than Colombians want to accept, and they've been raising the same issues as always with mass migration, disturbances in labor, wages, etc. The borders are closed now and there are no buses to Venezuela. What are these people to do? If the government doesn't take care of them, what will happen to them? From what a friend sent me (although it's unconfirmed and could be false news) the protections for not evicting people when they can't pay their rent doesn't apply to non-Colombians, and Venezuelans are living on the streets. Again I'll stress I don't know how real this is, and you have to consider the nature of social media news and the people who it interests. Those who have something to offer might find themselves a temporary arrangement. Those who have connections, family, friends, might live with someone else. I had a friend who apparently was going to do this yesterday, and live in a barrio outside of the city a ways. Those who have the least to offer are in the direst straits. Some were asking for help regularly even before the current situation. I'm currently helping four or five people I know to survive. But the prospect of three months. When you consider there is no way to get relief or let off steam or progress in any activities or projects in the near future, but only this situation, it becomes more sort of aggravating.

The streets still seem relatively peaceful. I don't think people are considering three months, and maybe the situation hasn't deepened in how dire it is yet. It's been only a couple weeks and they think another week or so. There is police coverage on most of the streets.

You can't really even make plans, since no one knows when there will be a vaccine or drug cure, although most likely a few months before a drug and a year before a vaccine. Everyone's just stuck in place.

The biggest question economists have for the current events is credit for corporations. Bonds are buying debt at whatever value you think it's worth, based on your estimation of the company that wants to borrow, and it's not indexed like stocks with NASDAQ. Over the years since 2008, a huge percentage of new debt have been by Tripple B companies, just on the edge of being below investment grade. 44% of the $10t market is Tripple B, a bigger chunk than the entire market in 2008. If they get downgraded because of the current situation and their prospects, a situation called 'fallen angels,' they'll automatically be removed from a bunch of investment grade bond ETFs because they'll no longer be investment grade. To get credit these companies will be facing very high rates ie having to give high yield to make lending appealing. Another aspect is that big companies that really didn't need to borrow, like Apple which 2008 started outstanding debt and now has over $100m, borrowed because they could do so at low rates, and they bought back their stock to raise it's price. Now, they may need government money, although probably a loan not a grant, to continue. So there may be a large spike in defaults, and this corporate bond market may do to the global economy what the mortgage market did to it in 2008. Also lots of companies have been borrowing when they really couldn't afford based on their fundamentals to because the credit cycle had been eased for the past 12 years. Lax credit standards. It could be bigger than 2008. The central bank has been purposefully stimulating the economy by buying safe debt, so credit institutions would focus on other companies, which they have done, and the companies could take advantage of this by getting credit for less because investors were looking for yield ANYWHERE. Investors are doing too much risk for the yield they're getting, which causes a problem when something happens like is now. Like the oil market in the US, although there will be pain coming, some think its good the credit system gets shaken out and take on a form where investors can get appropriate yield for their investments in bonds.

Right now both the bond and stock market are going down, and before that they'd both been going up, which tells some analysts something is wrong, because theoretically and historically when one goes up the other goes down. Now the only market gaining value is the treasury market.

Price discovery is impaired globally because the US dollar value is uncertain as the global currency. Everyone wants not only liquidity but dollars. The Fed has made it possible to exchange your best assets, treasuries, for cash.

There's a 'dollar crisis' where no one knows what will happen with it. Everyone wants US dollars.

People are talking about the problem in the global supply chain where one country produces everything for every country, and everyone is exposed to that link in the chain.

With all the money out there, maybe something will happen where now portfolio investors chase yield globally, maybe governments will limit that and instead issue sovereign debt you can buy and we spend it on hospitals, dams, whatever. Financing stuff locally. Fracturing the global finance world.

Continued in Part III: http://tttthis.com/edit/blog/talk-of-recession-and-coronavirus-2020-part-iii

Related material:

https://www.marketwatch.com/story/3m-hits-back-at-trump-says-ceasing-exports-of-n95-masks-will-have-opposite-effect-humanitarian-consequences-2020-04-03?siteid=yhoof2&yptr=yahoo

https://news.3m.com/blog/3m-stories/3m-response-defense-production-act-order?mod=article_inline

https://rstudio-pubs-static.s3.amazonaws.com/108399_66e9af15e17d49fbbdc250527611a580.html

https://www.youtube.com/watch?v=UlCYFh8U2xM

https://www.youtube.com/watch?v=q4-5OuI6aig