Continued from Part III.

Friday, May 15, 2020 During a monetary recession, the financial market alone is flooded with cash. No one else has money. Households and companies are paying down debt. Household and corporate debt and the Fed trying to meet inflation targets, all are pumping money into the banks. Because everyone's paying down debt, no one is borrowing money. Stuck with this cash, with only one borrower left, the government, you buy government bonds, which is why during the balance sheet recession, in spite of a huge deficit, government bond yields keep coming down. All the money has to go to the government. In the current recession people will be withdrawing money, savings and some borrowing distressedly to make ends meet. Savings are disappearing, everyone is coming to borrow, and the financial market becomes much tighter. We already see that in credit spreads in the corporate market. Much higher corporate borrowing rates suddenly. In spite of all the work of the Fed, it's much tighter now than a couple months ago. The Central Bank may have to continuously pump money into the system something like the 2008 crisis doesn't happen again. The Central Bank can play a huge role in keeping the financial market operating fairly smoothly.

The ECB, unlike the banks of Japan England, etc., can't add money to the system freely to make sure the financial market doesn't become too tight. In Europe no country can spend more than 3% of GDP on fiscal stimulus, so Spain and Italy, where it's needed now, can't do anything there, can't decide monetary policy. In effect the 18th country, whichever is doing the best, is where the money from all the other countries goes into for this reason of a fixed amount, capital flight between government bond markets. (If you go above that like Spain to 7% you pay a penalty on it.) Right now that 18th country is Germany.

Some think its likely that after the lockdown, and again after a vaccine or medication, people who have been out of work and have spent their savings will be in working and saving mode, while people who have been working and saving money during these months will be happy to spend it.

Global security provided by the US but without global challenges since like 1990. Which people currently think is normal but historically isn't.

The developing world is aging more rapidly than the rich world, but without the infrastructure, institutions, industrialists, capital structure, respect for democracy, propensity for growth and cooperation in trade, instead the rich world is retiring, and the developing world is aging without building capacity for value added.

The US has the youngest population in the rich world, already younger than China and will be younger than Brazil in 20 years. The US may become a country that builds its own stuff, trades with itself and maybe a select group of other countries. Trump has picked Japan, Korea, Canada, Mexico, and probably the UK later, and made trade deals with them. Without the Coronavirus, the US probably could have smoothly transitioned to this friends and family trade relationship, and now it has to do it in months instead of years, and will have American aspects and not global.

The next US president because of the economic structure may have to be less inclusive and less international than trump, people more disenchanted with the world. All the Democrats running now said Trump was being too soft with China. The next phase of US may be more mercantile.

China is aging fast, can't interact economically with the world without a global security system. They don't have a long range navy and 90% of their vessels can't sail more than 1000 miles from the shore which doesn't reach any consumption cluster. They import most of their raw commodities, through sea lanes. It may be that China internally doesn't hold together well, although it has been at peace since the WWII US order. China may implode at some point if it can't raise nationalist sentiment, which would be a news story. There is a lack of social unrest seen in China, and some say with social unrest visible things would change. The unity of the Han identity as defined by the CCP.

SA is moving tankers to places where they buy lots of oil, a port or populated area, to supersaturate Rotterdam, Suez, Korea places Russia pumps, and filling all the tanks there so producers have no where to sell their crude and they have to shut down pipelines and wells. In the US they can be turned back on and it takes 6 weeks to get produce from opening again. Nigerian and Siberian wells, shut down, might not come back for decades.

Iran is having to import for the first time, so it won't have cash to fund Iran in Lebanon, Gaza, etc. would be overextended and Turkey and SA could make plays there. SA is the home of ISIS and Al Qaeda, more violent than Iran which maybe isn't that violent. SA has a young new king consolidating power.

DAL if it reaches $14, CTC.A, WMT, VSTO, THO, ELY.

There won't be a labor problem, as the West loses Indian call centers and Asian factories, because there's 30m people out of work.

New waves of infection may be more controlled and localized in the US due to it's terrible road infrastructure between cities.

Some think Europe might fall apart as a unity. Partly because with a few years before recover and a population almost at mass retirement, Germany the country with the money won't want to finance the next few years for some other little country when they need it for themselves.

Bitcoin is back up to where it was a couple months ago, at $9300 USD.

Some more context about the Elon vs US government tweets he made. This weekend there were headlines the US was going to block Huawei chipsets from China. China responded, through their newspapers, that if the US did that they'd activate the 'unreliable entity list' and restrict or investigate US companies such as Qualcomm, Cisco and Apple, and suspend the purchase of Boeing. Musk with a more-than-ever important factory and market in China would be favorable to China after making bold anti-US statements. Apple seems to me a similar type of company where no news talks about Apple without mentioning the word China.

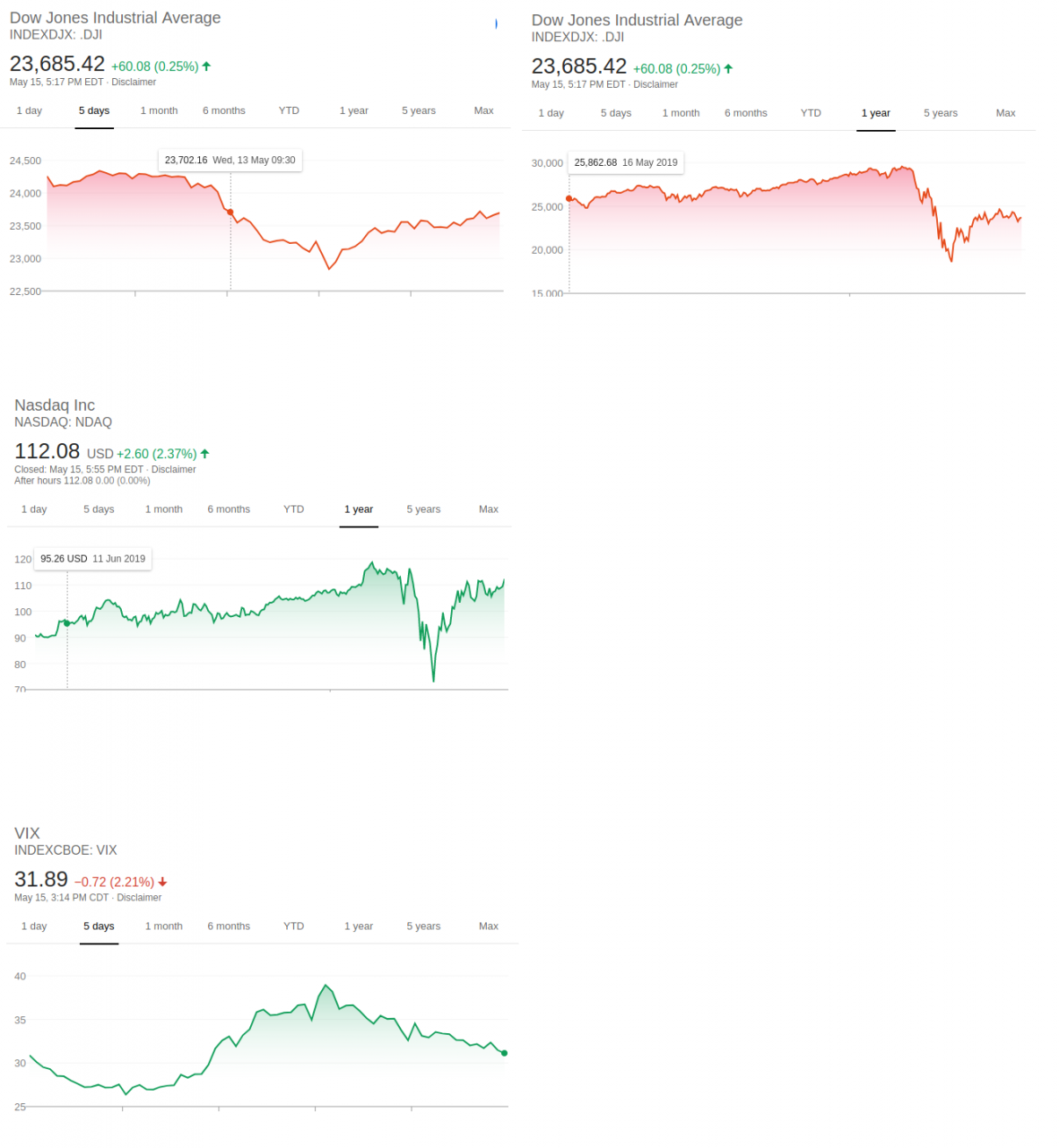

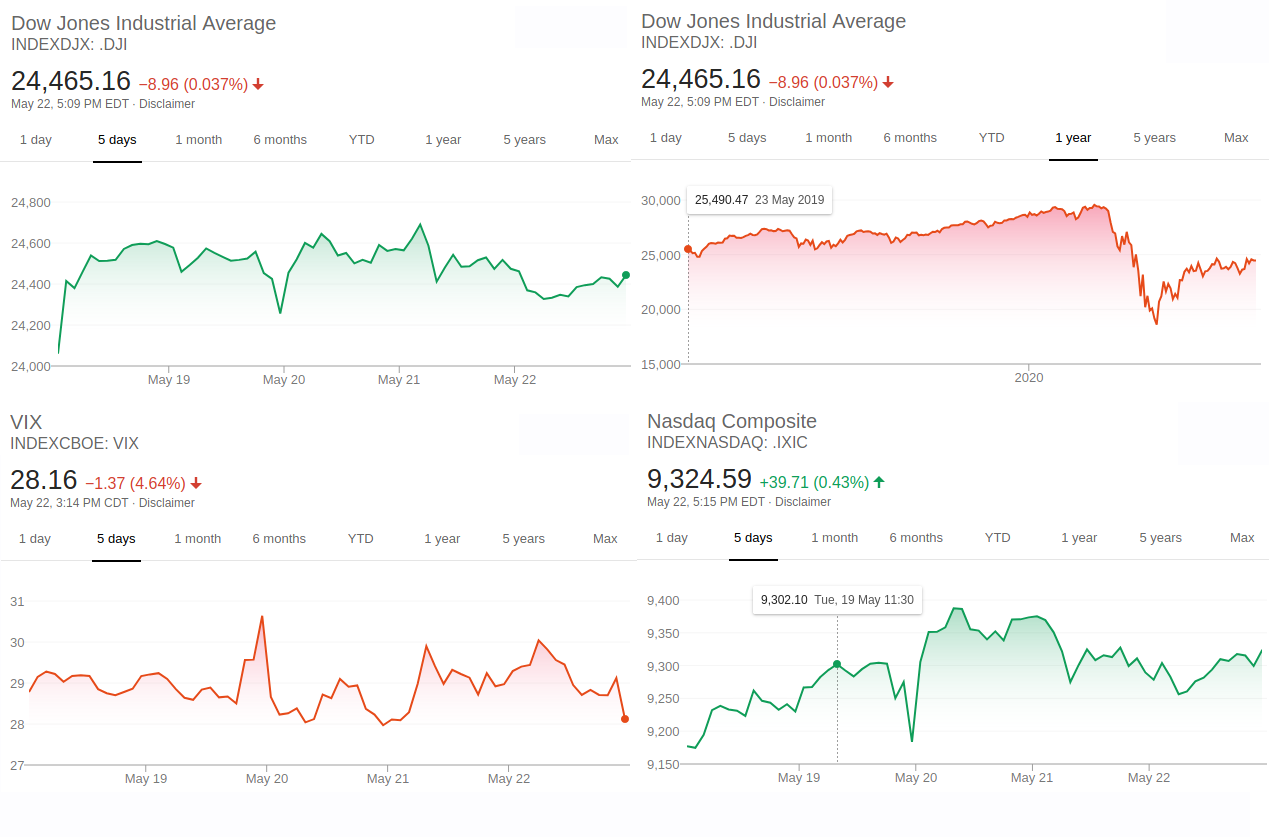

Some say the market, particularly the NASDAQ doesn't care about this news. Stocks continue up. On one hand, there seems to be popular will against China because they are seen to have not handled things nicely. Also I suspect that it's mob mentality. People have seen the market has not been phased by any bad news really so they may now think no news can phase the market.

Longer term, if this trend continues, companies will be faced with not continuing their current long supply chains that begin in Asia. On-shoring. Walmart imports a lot from China. Things will start getting more expensive. Independence causes inflation. Food inflation also is something people are expecting might come.

The Fed might end up owning 5% of corporate debt.

Wednesday, April 20 NASDAQ is going to tighten rules for Chinese IPOs to where some might not be able to list, and Trymp mentioned removing some Chinese companies from being able to list in US markets. Although this might just be to be able to say 'Look we got tough on China' although they're still there, and how markets make money is listing fees. They have offices in other countries like China trying to list new companies. Foreign companies might have to do books the US accounting style way.

I went into Delta and Canadian Tire.

Moderna publicized some results Monday morning this week which rose their stock and maybe markets. Interim results, a small study, 45 subjects, not peer-reviewed yet. The move was criticized by others. Fauci I think supported this. The criticism extends to him, who is under a lot of pressure. The owner of Moderna is seen as a consistent seller of the stock, not a buyer, and the news announcement was followed by a stock issuance. Some say it draws FCC scrutiny and might lead to FCC legislation. Omission to disclose material facts, insider trading, manipulation.

In the past couple months there've been 35 trading suspensions over Covid solutions, claims, treatments, vaccines. Something they'll look at is the integrity of the press releases, whether they disavowed information that may be in the marketplace.

There are about 100 vaccines being developed in a race, 9 or 10 in clinical trails stage.

Real estate is up over last year. Value is down average 5%, more down in higher end. People are moving, and companies are moving into the spaces of other companies. Values expected to go up are safe havens to cities, like the Hamptons in NY and Sonoma in SF, and places with tech presence like Seattle.

Questions about opening back up while avoiding lawyers, who apparently are pretty big in the J&J talc powder thing (allegedly, trace elements of asbestos found). People back to work, but staying safe. How much liability do companies have and hat protections do they have versus liability are being brought up.

The Senate passed a law to make Chinese companies play by the same rules all other countries play by in the US stock market. They have to do accounting the US way or they can't be listed. I think they have 3 years to comply. Some say this should have happened 10 years ago, when some people were saying that China would eventually come around naturally to be more like the US and other countries, while others thought that was a ridiculous presumption. Now, while many Chinese companies have grown very large, like Alibaba and Huawei, and are big stocks, a sentiment is getting stronger that China isn't doing it. They're not doing what they should be doing, that they've had a lot of time now. 'Enough is enough' is more of consensus now than for decades. That's a totally Western way of doing things, letting it go for a while and saying it'll come around, being polite more or less and then at some point feeling their trust has been exploited. I'm not sure if it might be for other cultures as well. That China's internal objectives are inconsistent with it's global responsibilities, pronounced significantly in how it handled the Coronavirus outbreak.

The US and UK will be taking the lead. What you hear more is 'this time we have to draw a line and it has to be firm.' The third blow to globalization in 10 years, the first was a pushback among householders against alienation and marginalization of some social segments in 2010, then the trade war in 2017 and 2018 which weaponized economic tools led by governments. The current phase is households with high unemployment not like the notion of China taking away jobs, governments weaponizing e-commerce tools, and companies localizing their supply chains as they shift emphasis from efficiency to resilience.

The New Normal 2.0 being talked about has even lower growth, higher inequality, more tenuous and artificial financial stability. Household economic insecurity may come up. Global cooperation and stronger architecture.

I went into Southwest, Enbridge, a little in Spirit and One Liberty Property.

Headlines that US tech giants might face anti-trust, and they're services are used by 'blacklisted' Chinese companies. Headlines of protests in Spain against quarantine.

Anecdotally, Tony Hawk goes into his coffee place in Dan Diego wearing his mask, and there are signs to wear them, and people give him dirty looks for wearing the mask, he said.

Among the shitty things our non-representative governments did during the crisis are: 1) China passed new restrictive laws in Hong Kong and removed 'peaceful' from their mandate for reintegration with Taiwan, and more activity in the South China Sea islands. US the Senate voted a majority to give strangers at the CIA and FBI access to all American's internet traffic through their ISPs I think, without a warrant. This was extremely surprising to me, and I'll probably write something about it. Canada did something shitty too but I forget at the moment. Canada is also according to the internet 'rushing through' the Enbridge pipeline which had a lot of opposition from I think environmentalists and natives who may want more money if it passes through their land or something, but the pipeline I don't see how it could be negative as long as they put in basic safety measures for accidents, and offers positives. Oh yeah, Canada passed a law where people couldn't use a type of gun any more. The type is one the police are permitted to use, I think, in which case it would be an over reach issue in constitutional limitations.

The China-US stuff is developing to where it might have to be looked at separate from the crisis if things keep going as they have been. It's an election year for Trump and he won't be able to run on a strong economy, which traditionally is a make-or-break factor but this is a different event probably. What he has left to go with is China, which will be consistent because he ran partially on being tougher on China four years ago. Xi also has a lot of pressure on him, and some think the Chinese government needs to galvanize the population in order to maintain political support which may be somewhat unstable particularly with the Coronavirus and how the Chinese government looks, so they may want some militarization too, at least ostensibly, which they can do with Taiwan, Hong Kong, the islands, and the US. More Americans when recently polled consider China an 'enemy' than before, up I think around 10 or 15% to like 40%. Chinese companies have benefited a lot from having their own set of rules to play by on American markets, differently treated than anywhere else, and some have grown huge like Ali Baba which has grown it's market cap to billions. Apple is seen as an issue in this. Some think an important part is if Chinese people can be made to see it in terms of China as an outlier globally, versus China as an adversary to the US.

I think around 30 Chinese companies are affected by the new law that requires them to play by the same rules, showing their accounting like other listed companies. These have been referred to as profelactive measures over emerging markets, accounting transparency for companies with close ties to powerful insiders. It has been said that a good audit committee is a fairly low cost high discipline factor. For smaller companies, many seek out listings as a good housekeeping seal of approval, so raising the standard would mean they would actually be entitled to it.

Some investors think business travel will change now, with less business travel for meetings, and this would affect airlines whose bigger tickets include business travel. Some investors think this means that small air lines that offer budget travel will do relatively well because they don't rely on business travel, although some of the budget traveler market will be unemployed. Others might think the opposite, that business and high fare travel will be what airlines focus on, since companies and wealthier people will not want to have their lifestyle limited. Examples are Spirit and Delta. I have both, but 2.5% Spirit and 5% Delta, and also 5% Southwest.

Over this week I added stocks and added to positions, and am about 80% invested in equities. Largest holdings are Canadian Tire, Vail, Norwegian Cruise, Carnival, Delta, Southwest. I also am holding Air Canada, Spirit, One Liberty Property, Macy's. I sold Camping World this week, as it had about tripled from it's lows and started to go down a couple of percent while the entire market was going up. It went down a few more after that but the next day went up about 8% in the morning before declining back down to around even. I had Camping World from before though so I think it was only up about 50% from where I bought it. I also sold Enbridge which wasn't moving much. It might be too early for it. I also have Fedex and L Brands from before. I didn't sell these stocks while I did sell Starbucks which was up when I sort of left the market. I knew they'd go down but I sort of wanted to keep them, and they were already down, partly for the experience. Next time I'll probably sell and buy them a bit lower and do it that way. I also tried to make a couple percent by selling when one morning everything went up quite a bit and started to drop quickly. I sold Norwegian and that ended up being the lowest it went that day. I bought it again later that day about a dollar higher. These are basically the stocks I'll be holding now though, although I might shift a few things around in minor ways.

Psychological issue. How long can a species be caged up before a breaking point. Today is Memorial Day, the traditional start of the busiest season for airlines and a lot of travel, with some things being booked up. People are all over the beaches in the US, according to the headlines.

We've seen a few big examples of how to add market cap recently. Spotify made a $100m deal with Joe Rogan which resulted in their stock going up billions in market cap. United said publicly it will work with Clorox to determine guidelines to disinfect surfaces. That medicine developer publicized it's premature, tiny study results as positive and added a ton of market cap, although the stock went back down when news came about details of the study, it's still up I think though. Bill Ackman, who became famous several years ago for some big relative investment numbers but hadn't done anything standout since, from what I've heard, came on live business news and sounded panicked and made frightened sounding negative comments amidst his making a huge short sale which might be the biggest ever trade. In a fairplay environment like the West, I mean fairly public spaces like markets, not private spaces like politics and legislation, when people make opportunistic moves it can work really well, and the less it's done by the group the more effective it is. People who had their money with Ackman at the time must have done pretty well, and he's established himself as someone not above doing that kind of thing to make profits.

On one of the first days of this log, I listed a few companies that might benefit from this type of event. Those mostly did benefit. A few others we've seen are stores like Best Buy that sell electronics that were allowed to stay open. Some stores that would have profited well were not allowed to be open. Grocery stores and online shopping. Tech in general, Zoom Video communications, Skype, Slack, Microsoft Teams, PayPal (which also works for government relief, as does Venmo), Chlorox, J&J, PG, streaming like Disney and Netflix and HBO and Kanopy (a surprise), online gambling, dating websites like badoo, pof, tinder, match, okcupid, zoosk (tinder and ourtime (much smaller) usage went up 6%, badoo up 3%, big food box delivery of groceries, online courses, online courses for kids like khan academy, cooking websites, Costco, Moderna (working on a vaccine), 'adopt pet,' 'adopt dog,' Amazon, Uber, WW (Weight Watchers), Chewy, online gaming, People have been searching more for remote, work-from-home jobs, remote jobs, work from home jobs, searches for home exersize, jump ropes, yoga, fitness mats, dumbbells,

Utilities went down but only around 15% while paying a dividend of 4 or 5%.

The cost of renting large crude oil carriers has been driven up by need of producers to put it somewhere to over $200k a day. Frontline, Golden Ocean, Diana Shipping and Scorpio as leaders in this could benefit (as yet unknown). However it takes time to build these.

Big companies, Apple, Tesla, Microsoft, FB, etc all have seen jagged but steady return to pre-March values since the sudden drop. Investors talk regularly about a company's books and how their balance sheet looks, whether they have money to maintain themselves for a year or two.

What has gone down the most is travel, hotels, shipping (global shipping demands and supply chain disruptions), banks that face loan risks, political pressure to withhold dividends (one of the few reasons to hold them). events, weather websites, restaurants, Yelp, Quotient Technology, Groupon, Casper, Trivago, Expedia.

Talk also about the Fed's big moves. Afraid of losing money for clients causes an investor to be conservative, and that has shaped their careers, embodying this conservatism, investing in companies with better futures. Now, being sheltered in their risk taking may create risk prone people.

Some people are saying 'never again with a lockdown/quarantine. It doesn't work,' and we'll see how that decision is carried forward perhaps, but hopefully that decision isn't too strong, because lockdown was correct with a new virus we didn't understand and threatening numbers we originally had. Who knows what the next one will be. The lockdown would have been more effective if implemented much sooner when no one wanted to.

Some analysts are saying the absolute or relative value of a company doesn't mean as much now because of the backstops put in by the Fed.

Continuation of events in a blog post called: Q2 http://tttthis.com/edit/blog/the-world-in-2020-q2

Edit in Q2 2023.

It's been a few years since the events of the Pandemic. The things that would have guided better government decisions, we knew at the start of it, so why didn't they act on that knowledge instead of the knowledge they acted on -----? The belief governments did wrong, sold medicines, etc., is much more widespread today than at the time, even among the sheep we noted all along the way, who despite better evidence and despite knowing their governments' records and that they didn't trust them, still preferred to believe them. It hasn't come all the way around. There seems to be a social/psychological pattern where, if people can be made to publicly take/support one side, they will continue to support that for a period of time, even when they know and have started to believe differently. How long is this time period? For the most part though, the wrongs, although admitted as wrongs by a much larger part of the population(s), are not thought about, considered, or even raised much, although they sometimes do get raised and complained about. For the most part the Pandemic is seemingly purposefully forgotten (because of the error of the people? or because of the unhappiness of the era?) So any wrongs done during the period are generally not prosecuted. Also interestingly, we've noted how the Spanish Flu era is 'strangely' forgotten, doesn't appear in history books, doesn't occur to us, even though it was a meaningful period which altered much. It seems this pandemic may be similarly treated.

Comments: 0