In 2019 I wrote that I considered Hong Kong the biggest story of the year. It's almost March and I think the story of the year, barring any large event, will be the "talk of recession." We don't know if we'll have one. No one does. Every economist I've seen says there must be one, but has been saying that for a long time. Saying it picked up last summer. There have been a few big dips in the indexes, but they're rebounded each time to new highs. (A week later, that this story would be the biggest - Coronavirus more than the recession, perhaps - became globally obvious.)

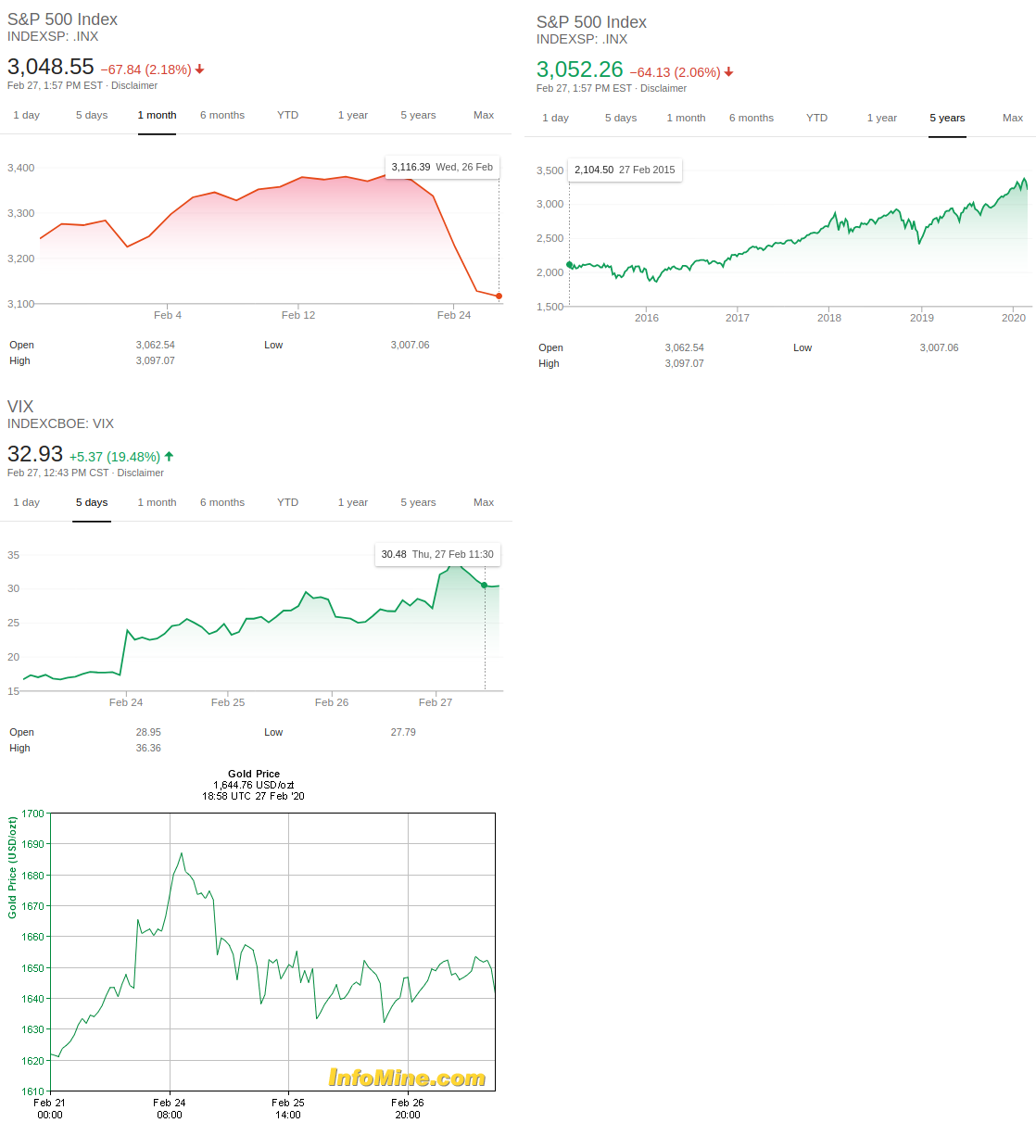

February 24 and 25 the indexes lost big. Gold had been going up over the week, perhaps as people anticipated a close proximity to a regular cyclical recession, but it went down on the 25th also. All (except one, of those I was watching) of the gold mining and silver mining, etc. stocks went down, after going up for a few days.

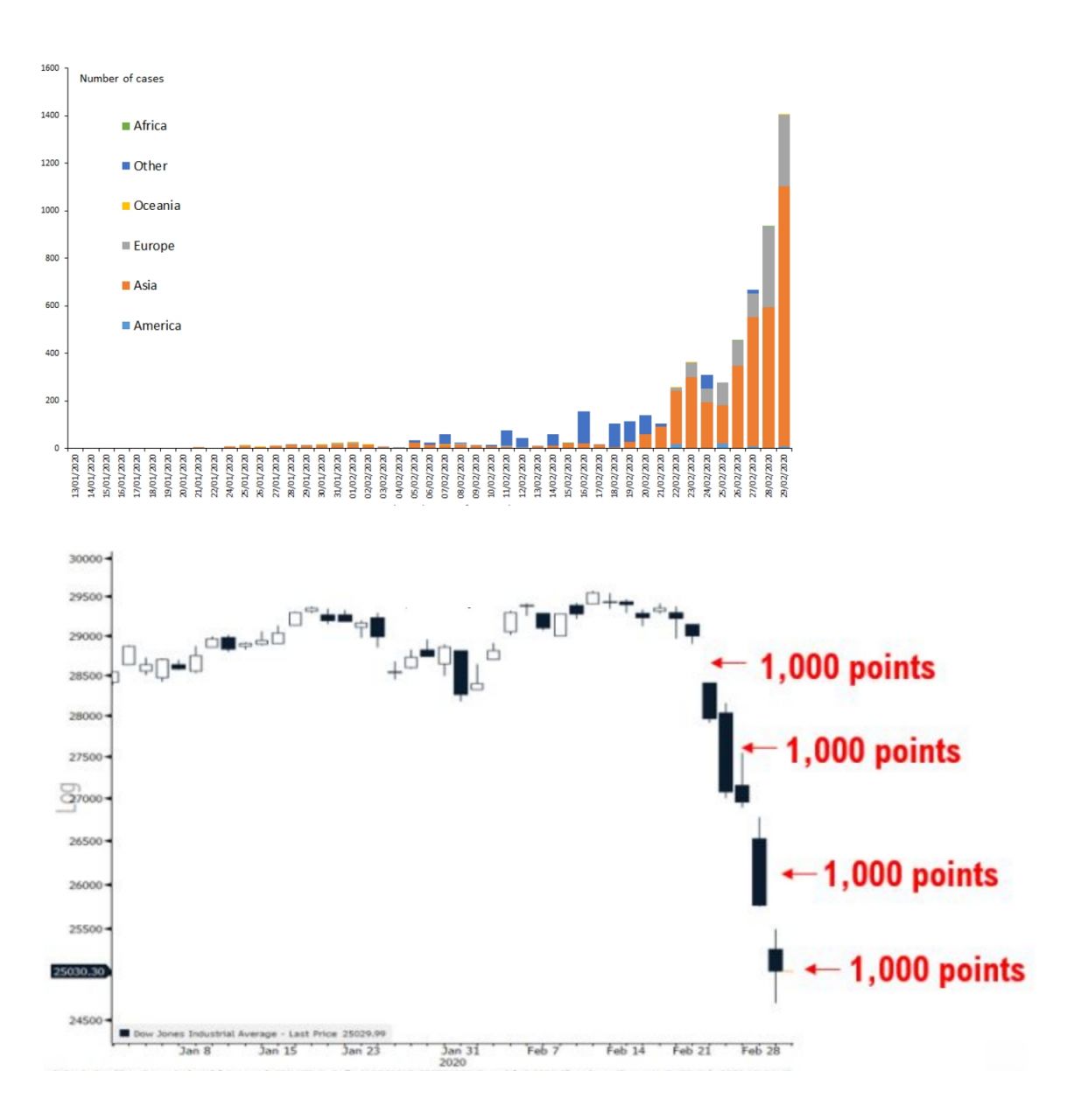

The talk is about the Corona Virus. It's a type of economic event no one had considered. The hardest hit stocks were those to do with travel and being in public, like airlines, hotels, and concert event promotion (energy is also said to be a bad investment), but all stocks were down except for a few. Mostly around 2% - those hard-hit ones around 8 or 9%. The idea of this type of market influence wasn't talked about before. The coming recession was going to come, everyone was saying, because it had to and always does as part of a cycle. And that once interest rates went to a certain point (they're very low), something would happen. However, a recession won't start while the consumer is still spending, and he didn't stop.

No one ever can predict stocks or the markets. No one ever has. Well-known investors were either in the right thing at the right time, or have been doing it for a long time and have just held good stocks. Over time most stocks go up. If they've held stocks for 20 or 30 years, those will be way up. If among their stocks they have something that had a huge growth, and people talk again and again referencing that particular one story.

So I don't say that a recession will be the 2020 story, but the event is the talk about what no one knows, that everyone is watching, that is a significant event for all of us, the 'talk of the recession.'

I was about to invest in YUM and gold. YUM performed in the 2008 recession, and has shown a steady increase since before it. It includes Taco Bell and a popular pizza chain. I was thinking about a recession, but not about this type of recession, where people aren't spending because they don't want to be in public places. Word is Corona Virus will stay through summer (whereas other types of viruses abate in summer), but at some point will run its course, unless something changes (a mutation or something unexpected). Reduced spending I guess could compound as businesses have less to spend as a result etc. Or it could bounce back. Unknowable for most of us. I expect that'll be a better time to invest in anything. People have also talked about certain gyms being good investments if the recession came, because these gyms are really cheap, like $8 a month, and they thought people would be unlikely to give up their memberships even in an economic downturn, but the socialization factor refocuses this. It's something our stock market hasn't seen before. Dollar stores also did well because they were cheap, but same story here. Also consumer staples did well SINCE the 2008 recession in which they dropped too. I'm not sure how to think about them in the light of Corona Virus. During recession people in large select retailers (well-known) with the lowest prices possible.

What companies don't rely on people interacting with each other? Even food delivery would be something you'd want to avoid, I think, because who knows what's going on in the kitchen there. Canned food? Utilities? I heard that rich people are hoarding cash right now. Entertainment like NFLX? Video games like EA? Telecom? Is there a prepping stock? News and news distribution services? Corona Virus-related stocks and Clorox are among half a dozen stocks higher this week. A company that delivers supplies to houses that is sanitary in its procedure? Ibuprofen and other anti-inflamatories? Telecommunications (video conferencing). Semi conductors and software are doing the least poorly. Robots are not disease-carriers generally, and could do delivery. Semis and software. Home gyms. Family games and puzzles.

Sometimes after a virus (usually, I heard) there is a bounce back because of pent-up demand.

2 days with huge index losses are rare. What will happen tomorrow?

February 27, markets continue a sharp decline..

"Unfortunately they have Hong Kong exposure, they have Asia exposure," a very interesting phrase I heard about CPRI which is way down and otherwise would be a more appealing investment. For the past 5 or 10 years the concern for companies has been "How can I get into China? How can we expand in China?" but having assets in China is currently a liability for businesses.

For markets, the issue is uncertainty/doubt. The "problem" stops once the government convinces the public the problem is containable. The Fed can/will attenuate the spillover effects from confidence demand by altering rates," one economist noted, likening the situation to 911 where people wanted to be sure there wouldn't be another terrorist attack.

Volatility is very high, so investors are making money off of calls, setting their buy price and sell price as value jumps around.

From a watching perspective, the event is interesting. No one knows what is happening at the moment or what will happen in the future. They don't even know a little bit. The round tables of economists and stock market newscasters are divided and no one is offering any confident assertions. If anyone did they'd be lying or wrong. It's like the beginning of a drama, where things go wrong or badly from an initially good, basically stable-seeming position. For the economy that was a steady recovery for the past 10 years from a serious recession, the rise of a huge new market of China, and tons of money to invest in the past couple years with the massive stock market bull. That might have been it's own drama, but I don't know how interesting of one, just watching and benefiting from profits. It's a healthy, undisturbed environment where not much changes or challenges. Here we're seeing a vigour which accompanies these types of economic times, and it's apparent in everyone - the round tables, the economic scientist commentators, the investors themselves I think. Everyone is moving in the situation. Perhaps not going to work, because that's something that's prohibited by the virus in China at least. Japan is going to not open schools for a couple weeks. We don't understand the virus yet. It's novel. At some point, perhaps there will be a low point, a solution or solutions, heros, and a change and positive movement.

There have been 80,000 confirmed cases, and almost 3000 deaths. The following statistics I don't think should be taken as descriptive since our knowledge of the disease is really limited, and our access to real facts from countries is also really flawed and limited.

The death rate for Coronavirus is considered (for now) to be 2.3%, basically set by Chinese events which is where the majority of cases have been so far. The death rate for the flu in the US is 0.1%. Part of this difference must be due to it's novelty. No one has any immunity to this new virus. The basic reproduction number is between 2-3 right now.

The older a person is, and the more health issues they have (heart, lungs, diabetes), the more dangerous it is. "The [Chinese CDC] study showed that ... among those ages 80 and older, the death rate was 14.8%, compared with 8.0% for those ages 70 to 79; 3.6% for those ages 60 to 69; 1.3% for those ages 50 to 59; 0.4% for those ages 40 to 49, and 0.2% for those ages 10 to 39. No deaths have been reported among children from birth to age 9."

Some suspect children are only getting subclinic (asymptomatic) cases is that their immune system is not developed as much as adults', so whereas adults immune response is causing problems children aren't having that response.

According to later data, it seems men are much more likely to require treatment (70% men), and death (3% men, 1.5% women). Also that underweight people were less likely to get severe reactions to the disease (less than 1% of cases). Regular weight and overweight people were much more likely, where regular weight people were only slightly less likely than overweight and quite overweight people).

Later reports from England's chief medical officer stated that the total Case Fatality Rate would be around 1%, higher for older people.

Some experts expect most people everywhere will have/have had COVID before a year passes. They expect it will be the 5th type of virus that will just go around every year (there are like 200 types of "the cold," which I guess belong to 4 types or something).

Now, US doctors test for it, but initially they were encouraged to not test for it unless someone came from China.

Symptoms appear usually around 5 days after infection (2 days to 2 weeks being the range). It is a respiratory disease, beginning and ending in the lungs, passing between people through the air, like the flu, generally through coughing and sneezing. To fight the infection in the lungs, the body floods them with immune cells to clear and repair damage from the infection, but the problem starts when in some people this immune response goes awry and the immune cells start killing a bunch of regular cells, causing a buildup of debris, worsening pneumonia. People can die from this. Some people who survive it have permanent lung damage, having holes in their lungs (a similar thing happened with SARS infections) as the lungs scar (which both protects and stiffens lung tissue). Lungs can fill with fluid to the point people can't breathe, also, because inflammation makes the membranes between the air sacs and blood vessels more permeable, which can fill the lungs with fluid and affect their ability to oxygenate blood. The body's immune response can also cause problems in other parts besides just in the lungs.

Looking at our long-time companion the seasonal Influenza bug:

Flu is a respiratory illness, but it is also a gastrointestinal illness, and an illness of headache, malaise, myalgia, cough, sore throat, and rhinitis.

Incubates 1-3 days. Viral shedding 1 day before symptom onset and persists for 5-7 days after symptom onset, high communicability through large particle droplets, aerosol transmission, surfaces, half of people have limited or no symptoms (although they can transmit the bug). Onset of symptoms is abrupt, last 3-5 days, recovery often prolonged, sometimes can have complications like pneumonia (viral) and bacterial issues. Worse with cardiovascular, pulmonary or other health issues. Generally comes and leaves rapidly, in a few months of the winter in the north and south (what about tropical latitudes?). 5-20% of the population carries it during its visit. There is a high morbidity, including around 36,000 influenza-related deaths in the US's 330m population each year, with about 90% of those deaths occurring in people over 90 years of age. Economic toll about $90b in US per year, including 200,000 hospitalizations. The vast majority of infections of flu run their course and all is well.

Major dissemination of flu are children and health care workers. Usage of antivirals has caused influenza to become immune (resistant) to our antivirals. Some are now worthless, others (Tamiflu and Zanamivir) are still effective, but being used so much though that experts expect resistance will increase soon.

Back to Coronavirus now. A person is most contagious around the time of the first symptoms (first starts to feel ill), so if people first start to feel ill, then go to work because they want to see how it'll pan out or don't want to think about it just yet, that's when they'll be shedding the most virus. Less infectious after 7 (this is doubted and could be a bit longer) days. However, a recent study in the Lancet by Chinese doctors reported they found a max of 37 days for the virus remaining in the lungs, with a median 20 days (varies by severity with 24 day median for those with severe disease status), so quarantine periods might be extended when this information becomes distributed. Also, some of the people who have no symptoms or very mild symptoms (maybe just feeling a little bit ropey) can be highly infectious, and we don't understand this part of the virus.

From a person who recovered, he first had a cold, then the cold was subsiding, then he got a flu which was the worst flu he'd had, then he got pneumonia (he said you feel like only 20 percent of your lungs are working and you hear a crackle when you breathe).

It kills people through Acute Respiratory Distress (not enough air in the blood, because the lungs are inflamed and the air sacks are full of fluid ie pneumonia). People are put on ventilators to make sure there's oxygen in the lungs and to breathe for the patient.

To treat Pneumonia, doctors have found over the past 20 years that they have to ventilate with low Tidal Volume (so they don't put a lot of sheer stress on the air sacks but forcing them open and closed), by inducing paralysis so the patient doesn't try to breathe over the ventilator because they're uncomfortable with the low level of carbon dioxide), and by putting patients on their stomachs for 17-18 hours per day.

For lung infections, for the past decades doctors have treated them sitting up (not lying flat) as long as blood pressure can support it. Also, plenty of liquids under the supposition it keeps the lung mucus thin so it can be carried up the trachea by the cilia and expelled.

Update: last on surfaces for up to 3 days, particularly on warm surfaces. Feces and bodily fluids up to 5 days. Can linger in the air for 30 minutes. Later update they say hard surfaces up to 3 days, cardboard 3 hours, and that it doesn't do well on food. I don't think I buy that though, about not doing well on food. Also, a cruise ship had said it found active virus 17 days after contact with a surface.

The immune system relies on white blood cells. Vitamin C is thought by many people to help, and it isn't produced or stored by the body, but can be obtained from pills or from red bell peppers (lots of Vitamin C) grapefruit, oranges, tangerines, lemons, limes, and clementines. While there isn't any proof out there it seems, there are doctors and others who say it really helps. Yogurt (the ones with "live and active cultures" like Greek Yogourt, can stimulate your immune system, and it also has Vitamin D, which is scientifically proven to nurture the immune system. Vitamin E supplements, but E requires fat to be absorbed, and for that reason it's nice to get it from Almonds (a half cup per day), which have fat too.

Apparently (from a good amount of quality science) Vitamin D reduces likelihood of getting respiratory / respiratory tract infections (viral and bacterial) and can make infections less severe. It increases the immune response. Vitamin D comes from fatty foods (fishes, egg whites, cheese, beef liver, and its been added to some orange juices, soy milks, dairy products), but we get most of ours from skin exposure to the sun (faster produced in lighter skin). Adjusted odds ratio if taken daily/weekly: 0.81, ie a 19% protective effect overall, or put another way 19% less chest infections. Daily dosage for Vitamin D is 25mg (1000iu), with a safe upper limit of 100mg. Vitamin D can be overdone, as it's fat-soluble so the body stores it, and it can get to toxic levels. The best way to know the right amount is to get tested by your doctor, because many people are deficient in Vitamin D and require more than other people who aren't deficient.

People do better in warmer environments too, because the immune system is more active, as well as a bit more humidity.

Zinc in some studies showed to decrease the time of a cold by half. But the type of ZInc matters: Zinc Gluconate lozenges that provide 13mg of Zinc lessened the duration of colds while Zinc Acetate lozenges of 5-11mg did not. Excessive Zinc consumption can lead to copper deficiency and can impair the absorption of antibiotics.

Vitamin C hasn't been proven to help, except in some studies that weren't able to be replicated. Vitamin C isn't stored, but can cause stomach aches etc in some people when they consume a lot.

With coronaviruses, heat destabilizes them. A small amount of microwaving kills them. Cold they're OK with though, and some species can live up to 2 years frozen.

February 29 (Saturday) and the markets kept going down for the week. The only companies that are doing well have to do with predictions of a stay-at-home, work-at-home lifestyle, such as semiconductors (video games, computers), teleconferencing, watching tv, etc).

New cases everywhere, including a couple in the US, elderly people where they have no idea how they contracted Corona Virus because they seem to have had no contact with the existing budding pandemic. Cases reported in 50 of our around 195 countries.

(Note: although point numbers are historically high, percentage of market value is much lower)

Countries continue to increase measures to inhibit the spread (travel restrictions, people in hazmat suits spraying public areas, cell phone apps that alert you when you enter areas with confirmed cases). US has done around 500 tests, and don't have test kits to really do more.

Will virologists and the study come to the fore this year? A longstanding project is the universal flu vaccine, which people say may come in 10 or in 50 years. How this study works is they take existing viruses (Spanish flu, avian flu) and allow/create mutations, to see how it might change in the wild by itself, then study those mutations and create vaccines. They also take non-human existing flus and study those and how they change and how they might be if they mutated to adapt to human hosts. This would be a benefit, because viruses are a serious risk to every person here, and its just a matter of time before the next serious one in the long historical string of them wraps around the world, like Spanish Flu did, killing 40m people in the first 18 months after it began and eventually affecting around 60% of people everywhere in period bouts over the next 30 or 40 years. Pandemic influenza gets forgotten completely (the Spanish Flu killed 675,000 Americans but left no trace on the national culture) and then "falls out of the sky" and the world is suddenly experiencing it, not just thinking about it, like it did in 1958 or 2009, depending on how old you are.

Viruses have huge potential for change (antigenetically, clinically, epidemiologically, antiviral or susceptibility). There is a huge immunologic pressure for them to change. This is what flu DOES. Potential for co-circulation with other flus. Potential for re-assortment (mixing and matching of components with other flus that have different age predilections and illness severities). The longer the flu is among us, the more chance there is of this occurring. (words of Dr Shult of UW School of Medicine). Vaccines can allow us to damp down succeeding waves of infection, but they can also force a disease to adapt/mutate more quickly.

Interspecies flus: The flu isn't very successful in passing from birds to people, but it passes from birds to swine and from people to swine more easily, so swine is a useful intermediary vessel between us and birds, and this is how we've gotten a few serious strains of flu recently. Another way is when the bugs have escaped from our virology labs to infect the public.

Comparison of Coronavirus with H1N1 (a novel subtype, to which the overall population had no immunity, of Influenza A virus) in 2009. The first cases of H1N1 were announced April 15 and a global pandemic was declared just over 2 months later. It was the first experience of a new, dangerous flu for basically everyone of working age. Response efforts increased dramatically, partly due to successful "flu surveillance" (reporting and monitoring of incidence, hospitalization, death, etc). The CDC and other organizations share a lot of information. There was no time to really prepare for much. H1N1 was controlled. H1N1 was very different from Coronavirus in that sick were obviously so, presenting symptoms in all cases.

With H1N1, children (usually hard hit) and young to middle age adults were particularly hard-hit. In Spanish Flu also it was young adults who were hard hit in terms of hospitalization and mortality. With seasonal influenza, usually the elderly suffer 90% of the mortality, as I mentioned already.

Stocks are considered to be priced above value. I've heard that over 90% of a stocks value is based on the company's profits over the next 12 months. That means that if stocks have dropped 10%, that should cover a consideration that there won't be profits for the next 12 months but then profits will return to normal. The stock market has been momentum-driven, and stock prices had gotten significantly above values based on potential profits. Some argue it's really the federal reserve that's been propping up asset prices. There have been many bulls and the market has been despised/hated by some. After the week of drops, economists are saying that prices had become reasonable. As long as the expectation, despite uncertainty, is that things will return to normal in 2021, the current events should be considered a "wobble," "a sell off," but something that doesn't destroy the fundamental values of equities. Economists compare it with the Lehman crisis, where afterwards credit was frozen for years and damaged the viability of the financial system as a whole. They say there might be a 20-30% drop at worst, for a year, compared with an 80-90% drop in the Financial Crisis.

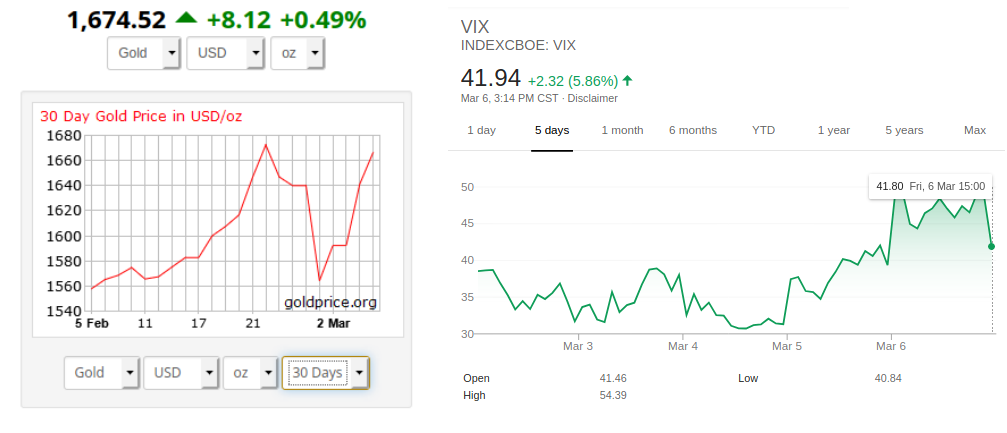

Bitcoin and other crypto are also down, as is gold, for the week. They were for a long time thought to be safe havens, and over the past year have evinced that, like when Greece had problems, etc., because its money that's not in the bank. Gold was up in the first part of the week, but then dropped. Personally I suspect that's because people were early this week talking about a regular recession more, and I think it might have been actually catching hold of some people (including myself) that it was about time, and then a Coronavirus scare/dip, which then everyone hyped Coronavirus, as well as it actually becoming serious and widespread in reality too. Mid-week people were talking about the numbers showing China's cases were plateauing and not many new cases elsewhere. Coronavirus was small and known only in China for a month or two. Isolated cases on cruise ships and the odd country. Then numbers shot way up (in accordance, I suspect, with the transmission-incubation ratio of 2 or 3 to one, which is peanuts for the first couple multiplications but then becomes a dramatic explosion. Rich people were hoarding cash, I had heard. If things continue as they have started the past week, this is the smart strategy, as emotion drives investment in the current market (more than financial analysis and investment on such a basis), and currently there is a ton of doubt, a lot of negative outlooks, not really any reassurances or assurances. There is also some fear. Lineups and unavailability of face masks and the threat of unavailability of medication is a serious thing to see. Cash is only smart if everything else is going to not grow or is going to shrink, since cash of course loses 2% per year due to inflation. But cash on hand can be invested when low points come.

China: Swine flu, bird flu, now Coronavirus? During SARS China was 4% of the global economy, and its contribution to global growth was maybe 20%. Today China is 20% of the global economy and it accounts for half of global growth. Now globalization is deeper than then. Now China is key for global supply chains. All over the world, companies are shutting down because key supplies aren't coming out of China. Markets are expecting close to 6% growth of China's economy this year, but best case will be 4% and worst case 2.5%, according to some economists. Italy was already in recession, Germany close.

Markets plummeted dramatically in Brazil after news of one case. What happens when there are a few hundred in Germany? Perhaps the panic is in part to do with the denial by leaders. This reminds me of Ebola and the denial and dangerous downplaying. But if leaders had said "Prepare yourselves, this is what's going to happen. This is what we're going to do to create the best possible outcome. This is what you need to do, and this is what we are going to do for you (take care of supply and security needs)." panic would be less. But instead we get "Everything will be OK. It's not very serious," followed by conflicting reports of actual facts.

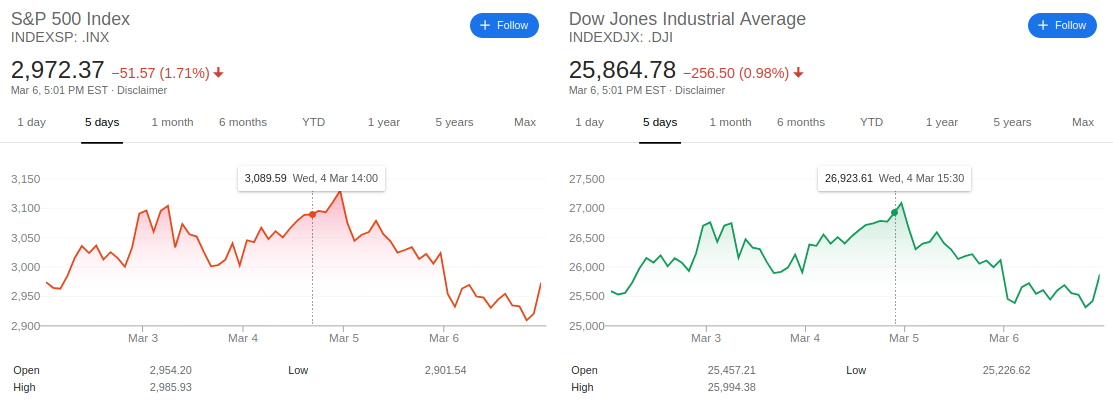

Monday, March 2 and the markets all went back up around 5%, the biggest bounce up or something. I sold my profitable stock this morning (when it was just a bit up, although it went up over 5% for the day) and am holding only stocks I've lost a lot on and don't want to sell at a loss, plus they do have a dividend.

Apparently Buffet's Berkshire is also hoarding a large stack of cash, I heard today, and recently explained it to his shareholders. He's holding 112b in cash plus 20b in bonds.

Tuesday, March 3 and the markets went back down again, about 2 or 3%. Most stocks went down. A few went up though, ones you might expect. Etsy is doing quite well (note: it shot way down the week after) and joined other stocks). The stock I sold yesterday morning and then went up went down today, losing most of the gains from yesterday. Losing stocks I held went down even more. Most gold stocks went up today.

It's thought of as a "true shock" in the sense it wasn't anticipated (and nothing was priced in) at the beginning of 2020 or even a month ago. Uncertainty is very high because we don't know yet much at all about the virus, it's severity, even if numbers aren't that scary right now. People watching stocks are thinking about supply chains and economic activity disruption, and also about demand effects from people not wanting to go to busy locations.

The US Fed cut rates 50 points (usually it's 25 apparently). Commenters now are saying it was a mistake, a sign of panic that won't fix the problem because the problem has to do with health and fear of going to public places, unlike 2008. Last week though commenters were some saying they wanted the cut, and I didn't really hear any saying they were opposed to it. At least one, though, said rate cuts would HELP, even if it doesn't FIX anything. Also a talking point is that the Fed doesn't have much room to go because rates are already so low.

March 6 (Friday). The markets went down again yesterday a few percent, and another percent today. Commenters and investors are uncertain and divided whether to say it's a blip or the beginning of a recession. I get the impression they're talking half to their investors when they're giving their opinions about what they're doing with the money they're holding in terms of investing, and seem happy whenever anyone makes a hopeful point. One made the point that it's a triumph for a diversified portfolio (50 percent stocks, 50 bonds) because these would be down about 2 percent from the beginning of the year. Which seems just silly to say.

I'm basically out of investing for the time being. I have no idea or any educated guesses other than that probably all markets and stocks will go down for a while, and that stocks that won't suffer from the Coronavirus (semiconductors, medicines, gold maybe) have shot way up during the past week and may be highly overvalued. I'll just stay liquid until some actual information is available.

100,000 confirmed cases was reached yesterday (in actually, there would have been 100,000 cases a week or two ago). Several thousand deaths.

The Chinese people, all of society, have been mobilized in a fight against the virus, and their reported numbers have gone way down. Some doubt the veracity of these reports, others believe them, considering how China (and Korea) have taken the virus very seriously, locked down travel, confined people to their houses, done a lot of testing.

Theoretically, if for 10-14 days everyone cut off contact and stayed home, and if food was delivered and if there was a vehicle driving around with test kits for anyone who called them, the virus would be contained and ended (not counting possible animal infections).

The US and Europe have shown, people say, are taking it more lightly, even thinking they won't get it (a Korean was quoted "You have to experience it personally to be able to understand."). Educated people in those same countries believe they'll get it themselves in a couple weeks, and that 60-80% of people everywhere will get it, and it will now be with us perpetually, and for this reason a virus made soon would be best (soon means 18 months to 2 years). The US government is starting to use "social distancing" to talk about how people should start behaving. "workplace continuity" is the tradeoff, with businesses trying to find ways to keep going. Some strategies include 2 shifts of workers who never meet and working from home.

An interesting point raised by an expert: That the young and generally healthy won't perceive personal risk and will govern their behaviour accordingly, based on personal risk and not on social risk.

South Africa has 7m (20% of the population) has HIV, some using strong suppressants and some not. We don't know how they will be affected.

Jeffrey Gundlach has also said staying in cash is better than 10 year bonds, because the rate with bonds has gone down to the point you won't make any money with them (you just won't lose money through inflation). He advocated gold, which is what I started moving on today in terms of how to get it. Crypto is another cash / investment alternative, and although it sometimes goes up, sometimes down, during economic uncertainty, I think there's at least a decent chance it will become more used, and a decent chance it will be valuable if ever cash became severely disvalued (like Venezuela, which now uses USD).

For a recession, he said he looked to the unemployment rate, which is almost definitional of recession, and also reflects consumer confidence (which has been very resilient and very high recently, although more recently the view of 12 or 18 months into the future has been dismal). That when the view of the present joins the view of the future in weakening that is also sort of definitional of a recession. Jolts figures (employment) have been very weak which may forshadow an uptick in employment.

The two falling knives, he said, are financials, which are being trashed by interest rates (low interest rates and low tenure rates banks can't make any money), and transport, which I've already written about above.

As to negative interest rates (a complete disaster for the financial system in whatever country does it, such as already has done Japan and Europe, which hasn't been catastrophic because rates remained in the US), talked about a lot among investment commenters, Jay Powell has said repeatedly that he favors doing large-scale asset purchases to negative interest rates. Quantitative easing.

Monday, March 9, the markets dropped around 7 percent. Saw a few headlines about the prices having priced in now a recession.

China has reported under 50 new cases in Wuhan on the latest update, no new cases outside of Hubei Province except 3 backflow cases. WHO says so too. We're really seeing the contrast of different political systems this year. Usually we just see how terrible China is, but now we're seeing it's still terrible (massive fullscale monitoring and information about everyone with no choice to opt out, and human rights seemingly a foreign idea) but good as well, as they've used their social monitoring tools to stop movement and association. People comment regularly that that may not be possible in the US or other Western countries, but from what I've seen what has worked in China hasn't been just the abusive state control, but technology and will. The will to impose restrictions on movement, and use of technology to guide people in doing it. They built a SEPARATE hospital in 10 days for infections from the novel virus, and were building a bigger one I think that would take a bit longer. They offer apps that tell where confirmed cases are, and where those people have travelled (a bit of use of monitoring data here). They use drones to scold people who go outside and do unsafe things like not wear masks or associate with others. Any country, even one that respects human rights, could do these things and contain a social virus in about a week if they wanted to.

People who have recovered could be the ones to immediately fill jobs in doing deliveries, testing, and other interpersonal communication and services.

Yesterday Italy (the most affected of Europe, with thousands of cases, which Germany and France now have over 1000 cases each) imposed strict measures.

In market commenting, rhetoric has changed in the past weeks, it seems to me, from more of the same (for years) general lazy optimism because everything's going up still anyway, to excitement but debating whether it's a blip, and investors saying they're going to buy / hold still, to now full on talk of recession, criticizing past government moves, etc.

Talk of how the lower the markets go, the less stocks are worth because of sell-off, the more people have to sell off. I'm not sure if I buy that, because I don't really understand for sure what they mean.

Talk of the 2020's economy: deglobalization, which to me I don't know but might be good. I was generally strongly against and believed against globalization since it started, and I'm not sure I've seen anything to change my mind in the last 15 years. Deglobalization will be a focus on countries that don't need other countries, cheap countries, oil-IMPORTING countries (because the oil price keeps settling lower). All the world economies are now well on their way to slowdown and stopping (China finally, Germany, etc).

Yen is up. It's been said the USD will go up against other currencies, and the Yen against the US dollar. (The funding currencies.)

Last week Russian and SA had some kind of falling out over oil, a price war, and SA said they were going to increase production (we already have shrunken demand). Might be oil companies closing soon. 10m jobs in the US fracking industry, oil has fallen to pretty much their cost of production ($32.5 per barrel today). Prices dropped 33%, their biggest drop since the Gulf War (29 years ago). Russia, with it's $7 per barrel oil (SA is $3 per barrel), no debt (SA does have debt), and their gold stores (they've been buying gold), very well positioned to go into a very long oil market battle, thinks they can thrive and put some competitors out of business (just when the US reached energy independence). Creates stress in US market and emerging markets. Others say most US companies will be OK until around $26 (a previous low), while less successful/good US companies will fail or sell their best assets to bigger companies (ie bigger companies could thrive in part). Commenters say that's good, though, because it's needed to be done for a long time. They have a lot of debt, and there are about 50 companies in the US supplying oil, and their costs are around $55 per barrel overall, whereas if you take out the smaller, more indebted (paying it off I guess) companies, average cost goes to $45 per barrel. Commenters think that the US shale market will need a massive government bailout but still won't survive.

SA announced it's production for April will be 12.3m barrels per day (an extra 2m barrels per day). Commenters say that means there's potential for a $20 barrel of oil in the coming months.

Theoretically, Russia could last longer because the Russian fiscal break even is $45 per barrel while the SA is $90, although both have stockpiled about a half trillion dollars. Russia has for the last few years stockpiled that amount in its sovereign wealth fund reserves, foreign reserves and gold reserves.

New age energy producers (windmills, solar energy, Tesla) just became much less competitive, and won't be able to compete, say commentators, meaning the fossil fuel industry might be even better positioned in a year.

I think investors, who have been in what has basically been a passive investment mode in the stock markets for the last few years, have made great returns since 2008, and had a few huge periods over the past couple years. Basically buying every dip and watching the stock rebound. Probably they are saying well I made a lot, I can take it out now. They're thinking I want to go back in when stocks hit rock bottom, and watch values rise again.

Because of the passive investing in the stock market thing, combined with cut rates by the Fed, volatility is crazy right now.

I suspect it's largely an emotional, uneducated investment body (excepting some real value investors who have been complaining recently about how overvalued the stocks are and keep rising, being "valued" at way past their value based on future profits. Emotional going up, emotional going down.

BP PLC dividend: 9.71%. Exxon Mobil div: 8.22%. Chevron div: 6.20%. Again Capital founding partner John Kilduff said by his math they should be able to keep paying even these lofty dividends, based on his math on some of the machinations Exxon and Chevron have been doing lately and if they stop doing buybacks.

Tuesday Brent went up to $38 today (up 13 percent).

Talk of Chloroquine (older Malaria treatment) with Zinc treatment that has been used in Korea (other option is an HIV disease). Zinc if it gets inside the cell can shut down viral infections of those cells (Zinc shuts down RNA-dependent RNA polymerase, blocking viral replication inside of the cells), but Zinc can't get through the cell wall (Chloroquine somehow opens up the ion gate to let Zinc through).

Medical bloggers are talking about Korea, who have very few new cases. They compare Korea with Italy, which has similar infection numbers but an order of magnitude more deaths. Two things: one is that Italy's known/recorded number is just the tip of a much bigger iceberg. Other one is that Korea's testing (they've done around 200,000 tests, so their number of cases at around 7,500 might actually be the actual number of infections) has helped. Korea is actively going out and looking for people to test, and they do a lot of testing (as much per day as the US has done period).

Wednesday, March 11. Leadership wasn't there in China at first (coverup, downplay), but later was there strongly, and with leadership and enforcement effort their cases are way down. Korea also. Italy just recently took strong measures. Commenters have noted that in epidemics and outbreaks leadership makes a big difference. When you have no vaccine and no proven cure, you rely on public trust. Understanding, trust, cooperation, and it has to be what's appropriate for a place at a particular setting.

Times (after WWII began, Polio epidemic of the 50s) of collective national sacrifice. Everybody is in it together. Everyone is at risk. A time of terror. A time when the pandemic fear gets going, people who went into it thinking they were going to be good soldiers and help people, stop seeing each other, they stop caring about each other, stop volunteering. People ashamed of how they behaved. Hospitals overwhelmed. People screaming and crying.

Governments in other countries (Italy) are looking to China as a model for how to handle the outbreak. To have the numbers stop increasing.

It's crazy. A coordinated effort of just 2 weeks could basically stall the virus, but no one wants to do that, and countries funnily don't seem to be prepared with ways to handle any type of emergency.

Markets, gold, and Brent down.

Bitcoin down almost 30%. Speculative/alternative asset like gold, but more volatile. People want cash. People are looking around and saying what can I sell? "Cut all your positions." High risk assets in a volatile market. With less liquidity, high yield, there's no bid.

Korea had another set of cases at a factory. I think about 100 people.

Thursday, March 12. Medellin had a fourth test positive last night. The first was about a week ago I think, a women in her 50's who returned from Spain. Colombia has a handful of positive test cases in about 4 large cities. It has since closed international flights, and when people can enter on a flight they must self-quarantine for 14 days in their house or hotel. Funny if they had done the same thing a week or two earlier, they would probably not have any cases in the country.

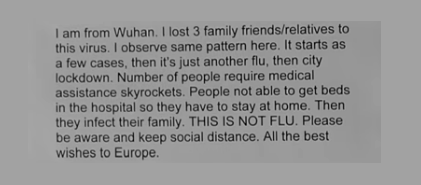

A letter from a Chinese to a European medical vlogger:

It seems the WHO's delay of declaring Coronavirus a "pandemic" is that there is now community spread in many countries around the world.

$9 trillion of world's economy is travel and travel-related. If 50 or 60% goes away in the market for 2 quarters, that's 5% of world GDP.

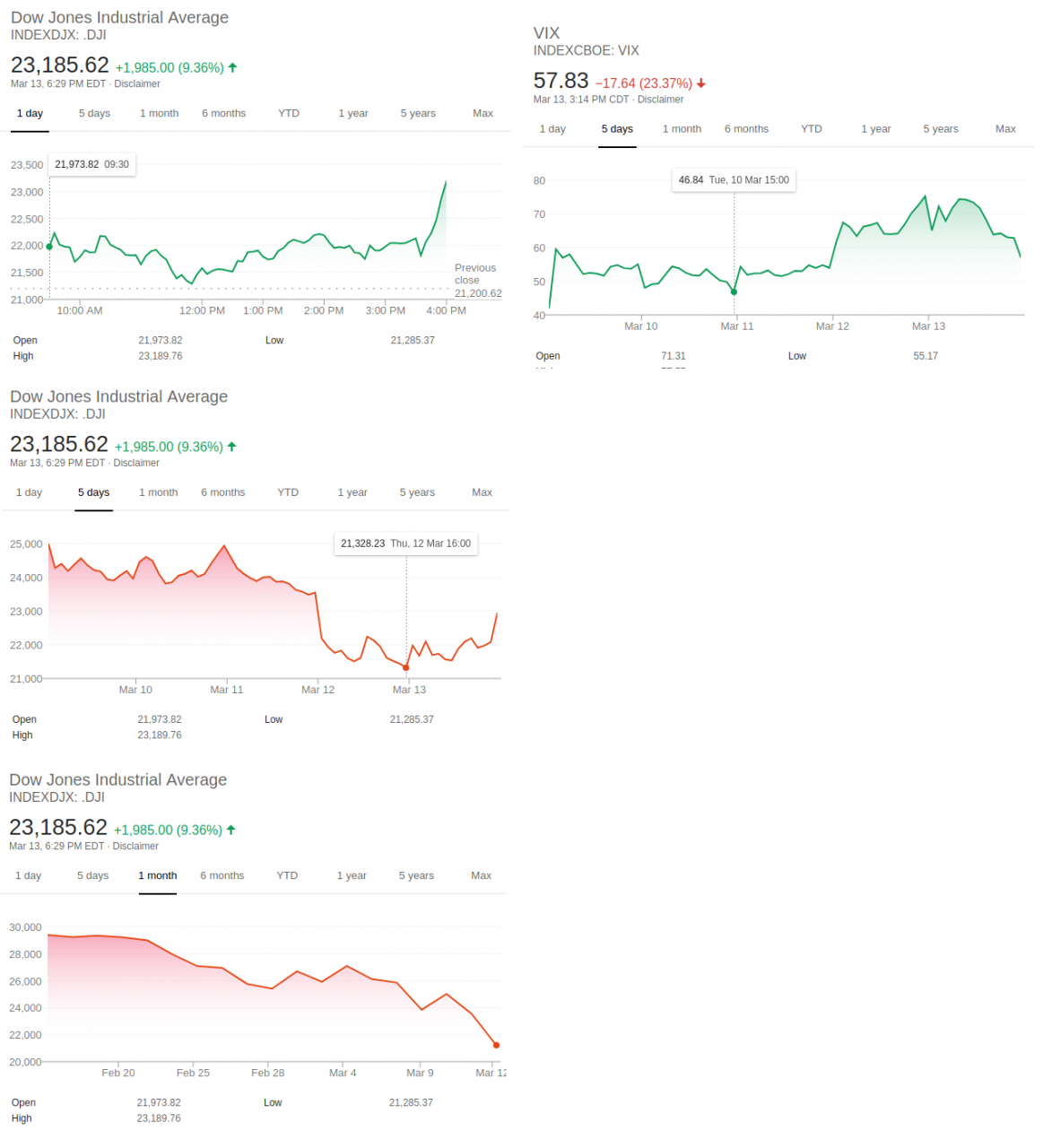

Stock markets went down 10% today, triggering the stop (it triggers a market pause of 15 minutes). Gold and Brent also down, Brent to $33.

US closed air travel from Europe. All sporting events are cancelled. Disneyland closed, and Disney postponed releases of it's new theater movies.

At this point there are three examples to look at. China acted within weeks in a completely repressive and authoritarian way, and it worked (directionally under control). South Korea acted in a very different way but with aggressive broad-based testing, and it worked. Italy recently acted with a broad-based federally instituted top-down shutdown of everything, and we don't know yet if that works.

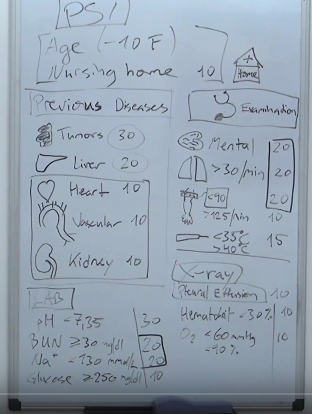

Assessing pneumonia chart:

Stages of an outbreak:

-Containment: This includes testing to find out who has it, to isolate them and try to keep the infection from the general public. This stage may not contain the virus but may still be useful, may buy time, provide information, etc.

-Delay: Institute social distancing to delay numbers and push the epidemic peak back and reduce the peak high so the health system is less overburdened, to build more health system capacity, and to control when the peak happens (avoiding winter sometimes when people already have chronic pulmonary disease obstruction exacerbation as in winter months, plus winter influenza, plus lowering the peak means less people will be off work and society can continue to function normally). It includes masks, washing hands, not gathering together and socializing, etc. At this point or later, there's less point testing people at random because we know the community has and is passing around the disease. After "containment" has passed you call for medical assistance if you feel you are deteriorating. The test is used as an aid to clinical decision-making at this point. Travel history is also at the "delay" phase irrelevant, which might explain why US airports don't do much or even question about Coronavirus when people arrive from anywhere.

-Research and Treatment: Including a vaccine and what treatments might benefit someone who's affected

-Mitigation: Making complications less damaging, such as low levels of oxygen and secondary bacterial infection

Things countries did well:

China, once it took the virus seriously, built rapidly separate health centers JUST FOR the novel virus. Hospitals are locations regular people obviously need, and treating Coronavirus there exposes the vulnerable (20% of healthcare workers in Lombardy, Italy (the country's epicentre) have been infected), the community, and healthcare workers to the disease. A separate location isolates a novel and still-developing virus. Specific special precautions, tools, and isolation architecture can be implemented (negative pressure ventilation, masks, isolated rooms that don't have much medical equipment, ventilator rooms). China built it's centers away from town on an existing transport highway. It's easy to get to and far from everything else. They also flew in 50,000 health care workers from other places. (Compare with video footage of Italy's overburdened advanced health care system general hospitals and 20% infection rate of health care workers in Lombardy).

China, President went on TV and declared war against the virus and led the people in taking it very seriously and everyone doing their part and not being irresponsible.

China, used drones to move around the streets to scold people who were out of doors without masks or congregating with other people,

China, used an app to notify people of the danger/safety of locations they travel to.

Korea, daily livestreamed community briefings by the US base there's garrison and installation commanders, with questions and answers, as well as multiple virtual town halls with their senior commanders.

Korea, immediately set about seriously manufacturing and using tests, testing aggressively and broadly. They have drive-through tests. You drive into a parking lot in your car, they test you through the window, it's free and takes 10 minutes, and you get results in 2-3 days. "You must find these people quickly. And you must not be frugal about the costs. It's the State's basic duty to support the lives of it's people," said one Korean mayor.

Italy, shut down country and closed international travel (although if it had done so sooner it could have contained the spread or at least limited it).

However, a Chinese official recently stated that the consensus among health care professionals seems to be that travel bans are not effective in containing contagious illnesses, and can make things worse by fuelling a sense of complacency."

El Salvador, with no confirmed cases and despite bordering three other countries, El Salvador placed the country under quarantine March 11, which would last 21 days, with schools closed and large gatherings prohibited. “How much would Italy give to be in our position and be able to declare a quarantine before having thousands of cases," said the president in his address. All foreign travel into El Salvador is banned (except residents and diplomats and nationals, who will be isolated for 30 days). “I know this will be criticized, but let’s put ourselves in Italy’s shoes. Italy wishes they could’ve done this before. Our health system is not at Italy’s level. It’s not at South Korea’s level," said the president.

“Why would a country declare quarantine without any confirmed cases?” asked epidemiologist Gerardo Chowell-Puente, chair of the department of population health sciences at Georgia State University. He wondered whether Salvadoran authorities had seen factors that indicate trouble ahead. “It gives the impression they are seeing a surge in hospitalizations and that may be overwhelming the system. I don’t think someone would declare a quarantine suddenly without evidence of a substantial outbreak.”

But in the president's speech that week he said, “And not because it hasn’t been detected. The necessary tests have been conducted and they’ve been negative.” The government did have 56 people under quarantine at the time.

“He feels free to take tough-looking measures, which are often troubling to civil libertarians,” said Geoff Thale, president of the Washington Office on Latin America. “And he takes steps, like closing schools for three weeks, which aren’t necessarily the most appropriate measures in a country without any confirmed cases.” Thale said the measures could be the president’s way of appearing “proactive and forceful” but could add to the impression “he’s willing to take pretty authoritarian steps. He’s gambling on what this will do to his international image. And this may have more to do with that than with whether health authorities would recommend these steps.” - as reported by The Washington Post

Part of the reason Korea did so well as they had coincidentally just performed a national exercise in virus management (I think in December).

Friday, March 13.

The USA is taking a lot of criticism because it isn't responding to Coronavirus (finally only closed international flights from Europe only, has done only 11,000 tests when Korea has been doing 20,000 per day, and today announced more recoveries than new infections for the first time), and now expects very broad infection. However, I don't know how the US could contain the virus with it's combination of travellers from China, Korea, Italy and other countries that had already entered, and it's unprotected border with Mexico (Mexico is recording cases as "influenza.") (along with perhaps their social science advisors understand what possibly could be (I don't believe it is, even if it's beyond the ability or will of most people/leaders) an impossible task of causing Americans to respond seriously to the virus, even if the government did). The same goes for Canada. Although this doesn't excuse the Canadian leader's lack of seriousness or care for the population, they share a border with an America which isn't trying to contain or even really limit the virus it seems. The US keeps promising tests will come in the week and not delivering. Also, the USA is a bigger location than Korea, where it is easier to distribute tests, which doesn't excuse the supposedly most powerful country. The USA and other Western countries seem very weak in terms of health response ability compared with the Asian countries we've seen (China, Korea, North Korea, Japan), and if it ever got into a war a health attack would be potent against the West (which may have been what happened, according to some conspiracy theorists). In the US (I read a message board on this), people over 60 are largely laughing it off, continuing to go to casinos, not withdrawing from public, meeting in dollar stores talking loudly about how unafraid of the virus they are, proudly going to amusement parks and concerts with work groups, saying "if it's my time ..." etc., even with existing health conditions, and their younger relatives are worried about them but they won't listen. The other reason the US may not be doing testing is that once a country enters the "delay" phase, they know the virus is there and they don't need to go around and test you each time you call them, and they probably knew the extent of the spread already and that it was past "containment." Similar reasons for not screening incoming arrivals, as I wrote above.

Italy is also been kicked around for it's poor handling of the virus. However, it was the first and hardest hit. And other countries, even with the benefit of having viewed Italy, don't seem to be taking any more serious measures.

Chinese billionaire Jack Ma donated 1m masks to South Korea, Japan, Italy and Iran, and 500,000 diagnostic kits to the USA. Chinese doctors arrived in Italy to help there, with their experience with the virus. Actually, it seems it was a group from China, the Chinese Red Cross, 31 tons of lung fans, respirators, monitors, tens of thousands of suits and masks.

70,000 people have now recovered from Coronavirus around the world.

People are getting into trouble for selling fake Coronavirus cures.

Markets went up late in the day about 9%, 7% 25 minutes before the close during a press conference by Trump announcing a federal emergency declaration (which frees up $10s of millions in federal aid and unleashes some regulatory red tape for doctors etc.) in which he took a "CEO-focused" approach, referencing CEOs of Target, Walgreens, Google, taking a more serious approach than the downplaying he's been doing up till now (saying he might do some minor things, and do thing if he HAD to do them), and that the US government would take measures to mitigate the Coronavirus impact. Individual stocks basically all went up similarly significantly, between 4 and 11%. For the day, gold stocks went down, as did the price of gold, down 4%. Oil went up 7% to $35 The VIX calmed down for the first time in a while, although its still very high compared to previous to the last couple weeks. Although the market went up, it still doesn't look like there is a bottom because there doesn't seem to be a base of people who want to enter the market. There is more people who want to get out. The bounce might have allowed more people to get out. Because there is almost no liquidity in the market, you get massive moves up and down. Some of the biggest up days in history were during bear markets, like 08 and 09. Bitcoin also bounced up along with everything else, from $4800 to $5600 (was $8000 two days ago).

People talked about the 25 minute 7% being "there's something wrong here" but I suspect it might have to do with people/investors watching for a bottom (who maybe don't have much information on the virus and think the outcome will be much shorter term) and once some people started buying, many jumped in thinking it was going to shoot up suddenly (which it did for the day).

A question economists are asking is after the global recession, when the economy restarts, how is it gonna restart? When we get taken out of our comfort zone, we become more risk averse. Some say it will be about the critical mass, circuit breaker, having faith in the plans of policy makers (a plan of stage 1, stage 2, stage 3).

The bond market closed at 1%, record volatility. A historic move, and the bond move is telling us something awful, commenters think.

We don't know where credit is right now.

Corporations are taking out their entire lines of credit, like Boeing did yesterday. Bringing the cash in house, in case you need it as there is a sales and cashflow squeeze in an economic slowdown. As equity prices draw down, companies become less credit worthy. Uncertainty about whether a company will be able to pay its short-term debts. What if firms that rely on short-term borrowing in order to meet their many cash needs, are able to continue because the good they need delivered them can't be delivered to them cause the firm that makes them can't. There's a lot of debt in the system.

Economists are monitoring whether the shock will flow into the CREDIT system, or whether it will have a second order impact of creating credit problems. If it does flow through the credit system, they're thinking about two sides of it. One side is that never before have central banks been more plugged in to provide liquidity where its needed anywhere in the world. This is an ecosystem created by the problems of the 08 09 Financial Crisis. On the other side, there are high levels of debt and interest rates are low and there is a lot of liquidity already, so the impact of monetary policy is limited in its ability to offset a major shock.

The key to the virus is quarantine in our homes, say many. Countries shutting down.

John Chambers (former Cisco CEO who went through 5 economic crises and 5 health crises in his time) gave some advice on how corporations should weather the storm. 1)Don't hide, be very transparent, say what you know and what you don't know. 2)Outline what you're going to do, how much of the thing was internal-inflicted and how much was an external issue. Give your 3-5-7 action plans, whether you're a small company or a country. 3)Paint the picture for what you'll look like a year from now and two years ago. 4)Be open with all constituencies/stakeholders and give them regular quarterly updates, and make one move/change at a time and move on it aggressively.

In 1997, during the Asian Financial Crisis, everyone was pulling out of Asia and his company doubled down there, and a year later they had number one market share. In 2001 they got surprised, outlined a plan in 51 days, in day 52 gained market share.

He also said that problems usually will last longer than you think and be deeper than you think, and is thinking 3-5 quarters for the current issue.

The UK MP make an announcement the virus had a hold and he thought it would get worse, and they were moving to a "limiting stage" as I wrote about above. If someone feels ill they should self quarantine at home for 7 days. The issue apparent to them is that there will not be enough beds.

The WHO has said Europe is the new epicentre of the pandemic. China had 8 new cases and in Europe it's doubling every 4 or 5 days.

Without city lockdown and containment efforts it's thought there would now be 67 times the amount of infected that there was when they stopped doing coverup and the government took the issue seriously. There are 80,000 cases, up about 10,000 or more since they took it seriously, and now there are 115,000. It's guessed that otherwise it would be 115,000 x 67 = 7.7m. It's also guessed if China had acted 3 weeks earlier (no coverup) there would be 95% less cases.

People everywhere seem to be looking for leadership and a concrete plan that they can coordinate with everyone else through. Usually we don't want or need the government in our lives or businesses. Since governments impose so much, and harm people so much through this, we develop strong opposition and despise governments and resist anything they do. When we actually need leadership, perhaps they can't provide what people want/need and people don't want to receive it.

The uselessness or maliciousness of the WHO, with all their medical expertise and access to information, was shown in this pandemic. Those countries who followed along with WHO recommendations are highly infected. Only those who did the unpopular thing and closed off borders earlier have no cases. Any country that references the WHO in justifying or giving reasons for it's actions in the future must be idiots. Later on, the WHO (now advocating quarantine) is criticizing countries that "aren't doing enough."

Saturday, March 13 Guatemala had it's first confirmed case, a man who returned from Italy just a few days earlier. If they had closed their flights a week ago, probably not have any cases. All the president there did was expand the travel ban to Canada and the US.

"I feel a bit frustrated this month, but Ive become so much more aware of how precious our outside world is." - Wuhan 6 weeks into the pandemic quarantine.

After two months, they think, they will have quarantine measures lifted and can move around inside the community if the whole community has no symptoms for 14 days. They log into WeChat and get a health code (Health Code Online) and report if they have or still don't have symptoms.

They don't know how serious their neighbours will be about it, but it is warned that if a community hides any cases it will be punished. If they stay healthy the community will be rewarded with money.

El Salvador has no confirmed cases. Haiti also has no confirmed cases, but hasn't imposed strong measures.

Companies and bankers are meeting with private equity firms that don't usually lend to companies ("shadow leaders / shadow banking system"). Half the market vanishes in a pinch, and people want to shore up their liquidity. Corporate officials are rattled and want to make sure they have cash on hand to outlast the downturn.

Gold down 4%, Brent at $34 (Im not sure if my last couple days were right for Brent, it looks like the page I was using wasn't changing with reloading it). Bitcoin around the same.

According to Western news, a Chinese tycoon who criticized Xi's response to Coronavirus vanished.

Kijiji banned listings for toilet paper, hand sanitizer, face masks, and other items. People have been driving trucks up to large retailers and filling them with these items and selling them online for markups. Other people are stocking up bigtime.

Coronavirus is a scientific challenge and a social challenge. It could be either or both. In it's frame, countries are appearing great or poor in their ability to deal with it. Currently, countries are praising South Korea for its handling, China for buying other countries time, criticizing Italy and the US.

Possible the reason people seem so unconcerned and lassais-fair about the outbreak in China was that the past several serious disease outbreaks (over the past 20 years, several serious Influenzas, Ebola, and Zika), although threatening, were contained and didn't threaten most people, and people probably are accustomed to this outcome to the point they don't feel threatened by new viruses.

Continued as (PART II) : http://tttthis.com/edit/blog/talk-of-recession-and-coronavirus-2020-part-ii

Most recent (PART III): http://tttthis.com/edit/blog/talk-of-recession-and-coronavirus-2020-part-iii

Watch:

When people stop hoarding. When people stop worrying about having enough.

Related reading:

https://www.theatlantic.com/health/archive/2020/02/covid-vaccine/607000/

https://www.livescience.com/new-china-coronavirus-faq.html

https://www.nationalgeographic.com/science/2020/02/here-is-what-coronavirus-does-to-the-body/

https://www.mayoclinic.org/diseases-conditions/coronavirus/diagnosis-treatment/drc-20479976

https://www.youtube.com/user/Campbellteaching/videos

https://www.youtube.com/watch?v=vM8xVHP6Dgg&list=WL&index=7

https://www.washingtonpost.com/world/the_americas/el-salvador-nayib-bukele-coronavirus-quarantine/2020/03/12/d920e9a4-6404-11ea-8a8e-5c5336b32760_story.html and https://www.bloomberg.com/news/articles/2020-03-11/nation-with-no-coronavirus-bans-visitors-and-quarantines-locals

Comments: 0